What Is Celstia?

Put simply, Celestia is a data availability layer on a Proof of Stake blockchain – we’ll just call it a layer 1 blockchain to keep it simple.

Celestia uses a modular design to help scale the capacity of the blockchain. Instead of having the entire blockchain handle every single task, a modular design allows Celestia to separate execution, settlement, and data availability tasks from each other. You can think of each layer of Celestia as a module with its own specialization.

One of the biggest advantages of Celestia’s design is how inexpensive it becomes for new protocols to launch on Celestia. Instead of spending millions on fees from data requests, protocols can run light nodes that quickly synchronize with the network and pull critical data.

Light nodes require significantly less processing power, bandwidth, and storage space when compared to the full node design used on other blockchains. Users can run light nodes on personal devices, and protocols can save money by being able to pull data inexpensively without sacrificing decentralization.

Why Stake TIA?

The ease of launching new protocols on Celestia is why we’re here today. Staking TIA (Celestia’s token) gives you the opportunity to get listed for a variety of airdrops coming from new protocols launching on Celestia.

Already, protocols like Dymension and Saga have airdropped tokens to TIA stakers, adding a sizeable chunk to their portfolio. While staking TIA has a time lock up, receiving 1-2 airdrops will quickly make up for your inability to use your staked capital.

In this article, we’ll look at staking TIA with a validator and 2 different protocols that will get you eligible for an airdrop.

How To Stake TIA With A Validator

The easiest way to stake TIA is with a validator. The first step is sending TIA to your Keplr, Compass, or Leap Wallet.

Once you have your wallet downloaded, you can send TIA to your wallet from an exchange. You can also send ATOM and then swap ATOM for TIA inside your wallet’s swap function.

If you already have crypto, you can use a website like SideShift.ai or ChangeNow.io to swap your crypto for TIA.

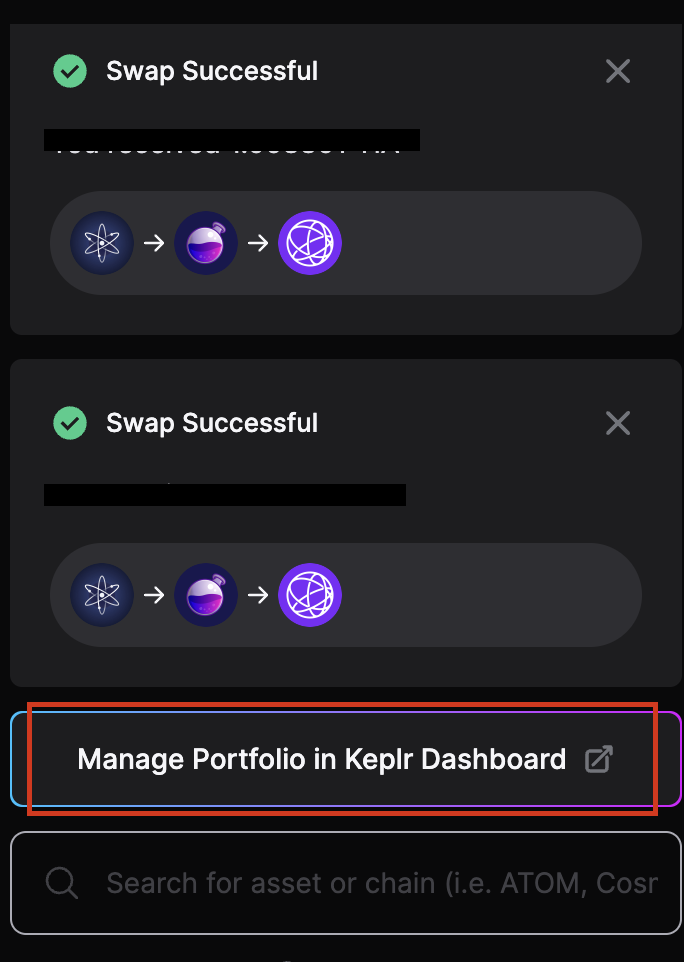

Once you have TIA in your wallet, open Keplr, scroll down, and click “Manage Portfolio in Keplr Dashboard.”

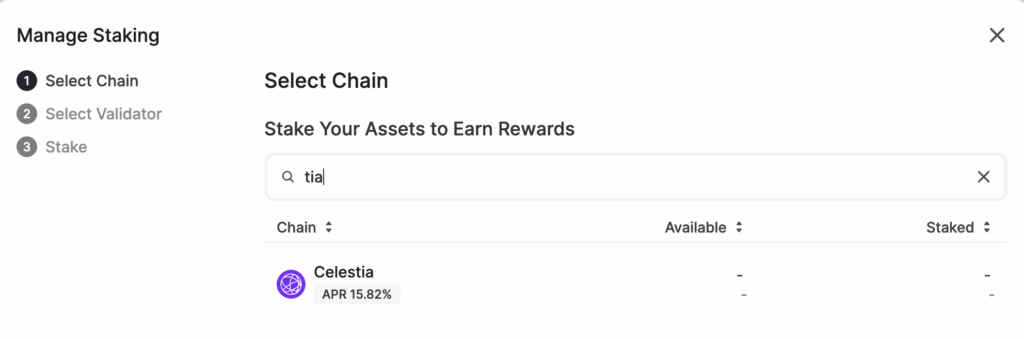

With the Keplr Dashboard open, click on the staking tab in the menu on the left side of the screen.

Choose Celestia as your chain.

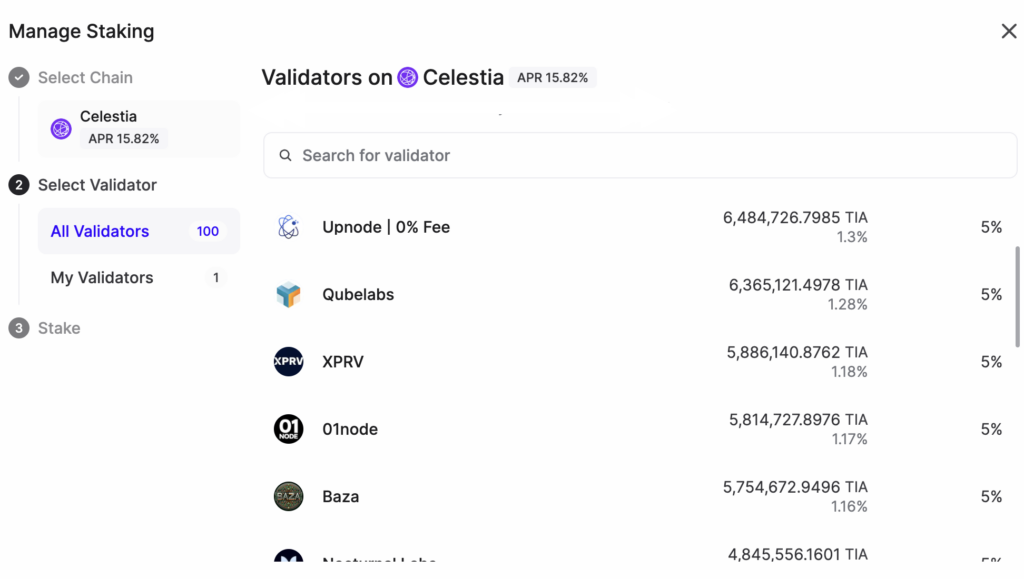

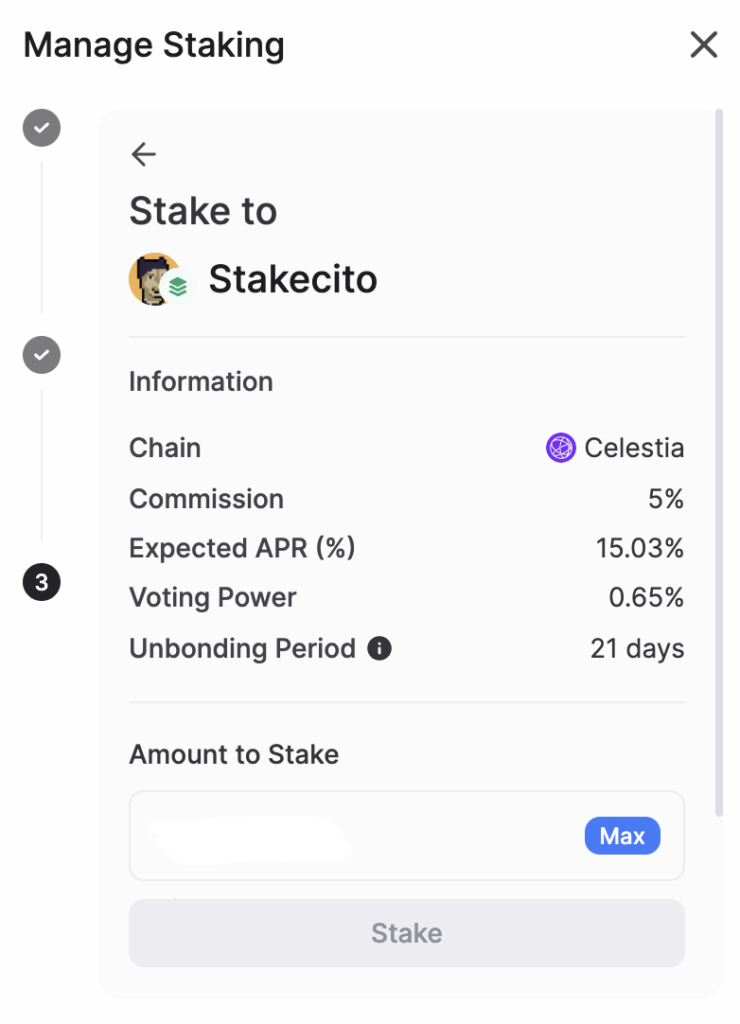

Now, you can choose from a list of validators you can stake with. Validators charge a commission to cover hardware and bandwith costs. Look for a validator that has a commission of 5% or less. Research different validators and avoid ones with a centralized setup. While researching validators, you may come across some that plan to launch a token – validators like frensvalidator and stakcito might do additional airdrops.

Choose a validator, enter the amount you want to stake, then click stake and approve the transactions.

There’s a 21-day waiting period when unstaking your TIA. In theory, the airdrops should more than pay for the risk of having your capital locked up, but the waiting period is a factor to keep in mind when deciding how much to stake. Other airdrops like Layer Zero require you to use your capital to pay fees instead of having it locked.

Staking TIA With Milky Way

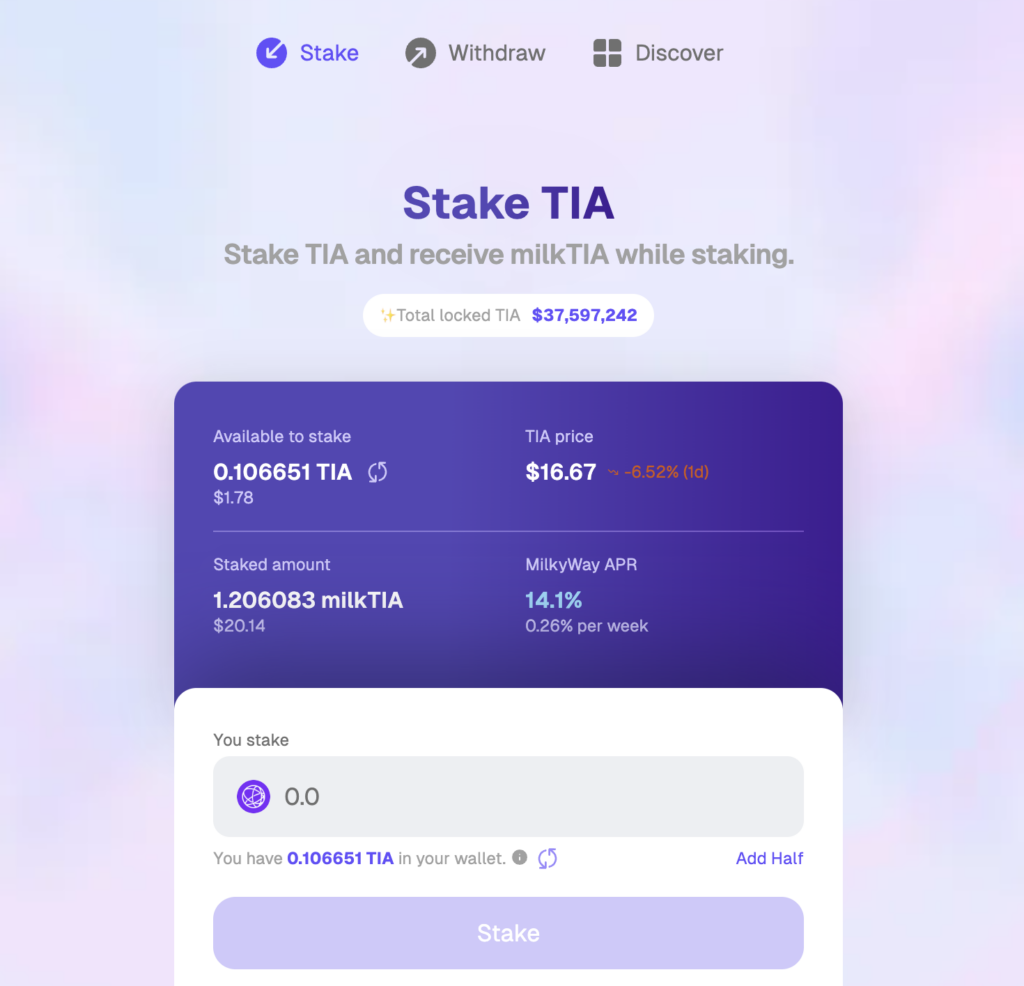

Milky Way is a liquid staking protocol likely to launch a token in 2024. By staking your TIA with Milky, you can position yourself for the airdrop.

The 21-day waiting period also applies to Milky, but you can pay a fee to access your tokens immediately. If you choose to wait, your withdrawal is free.

Go to the Milky Way app, connect your wallet, and then choose how much you want to stake. Approve the transactions that come up, and you’re done!

Staking TIA With Demex

Demex is a decentralized exchange that provides spot, perpetual, and futures markets.

https://app.dem.exchange/trade?loginType=main

Demex is doing a points system for their upcoming DMX token airdrop – using the protocol will help you earn points.

If you already staked TIA with Milky, you can lend your milkTIA to Demex, which will help you build up points. You might as well lend your milkTIA instead of just having it sit in your wallet.

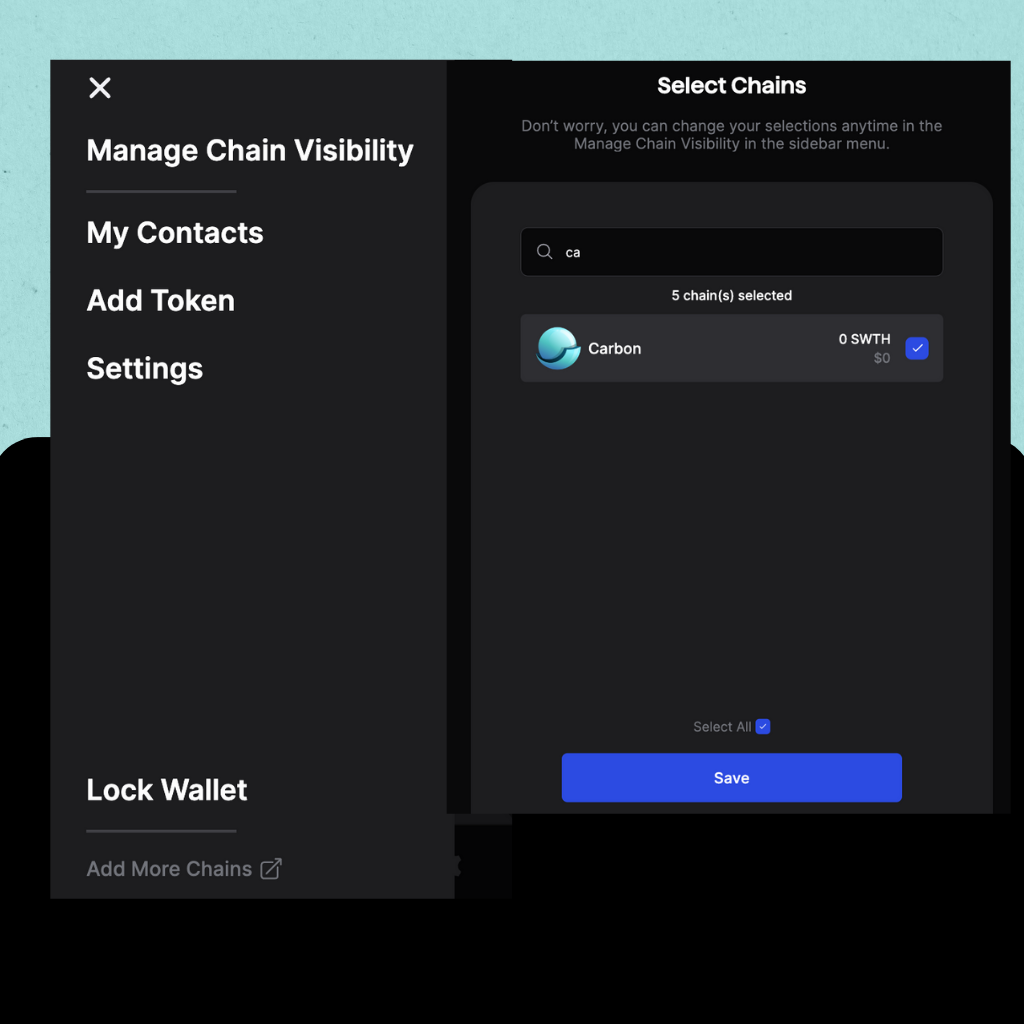

Demex is on the Carbon chain, which you’ll have to add to Keplr:

- Open Keplr

- Click the menu

- Click Manage Chain Visibility.

- Type in Carbon and save the new chain to your wallet.

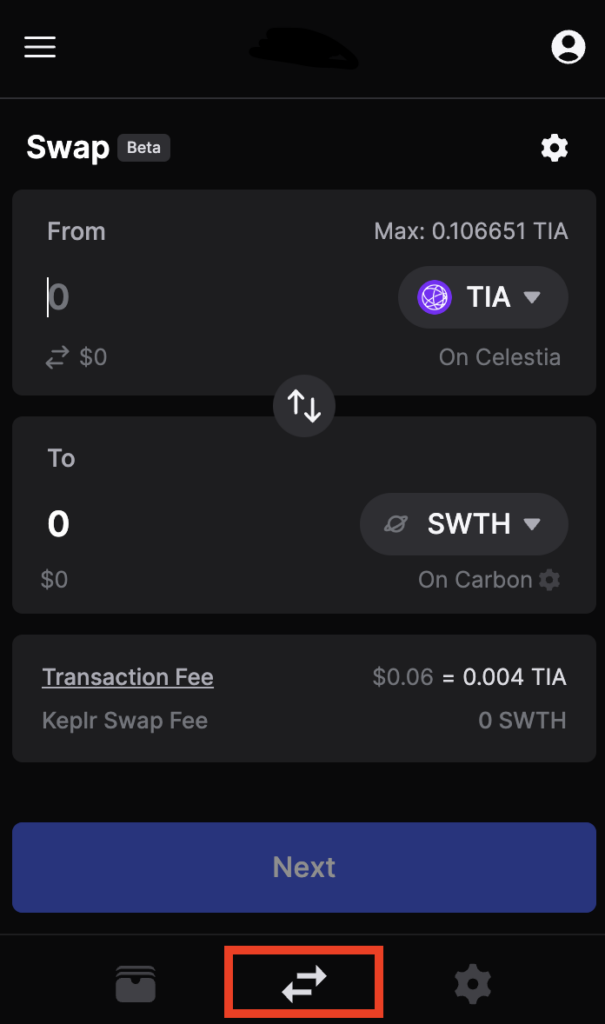

You’ll need SWTH & OSMO to pay for gas fees on Carbon & Demex – open Keplr, click the swap icon, then swap TIA for SWFH. Then, repeat the same steps to get some OSMO. You’ll only need a few dollars for gas for lending, depositing, and withdrawing.

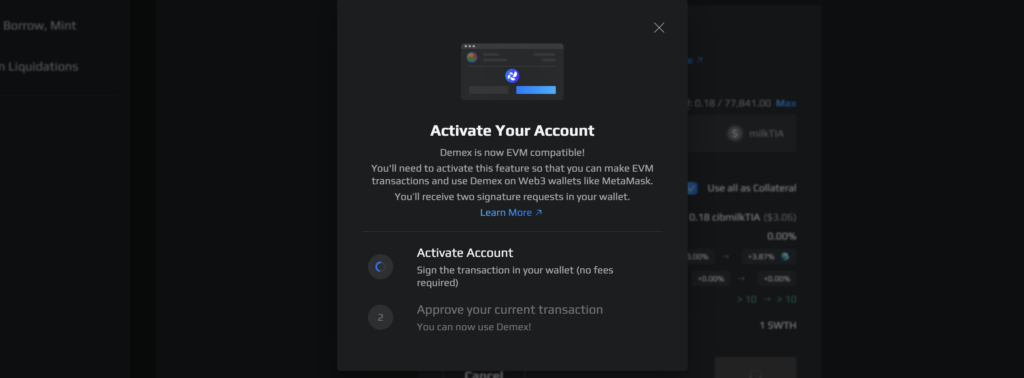

Finally, you can go back to Demex and connect your wallet – you’ll need to approve some transactions to activate your account as a first time Demex user.

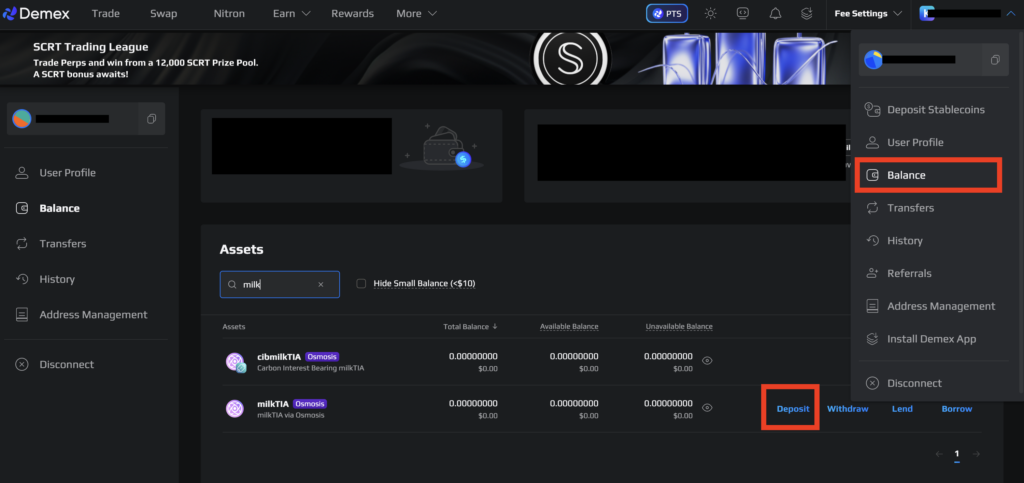

Next, click on your address in the top right corner, then click “balances.”

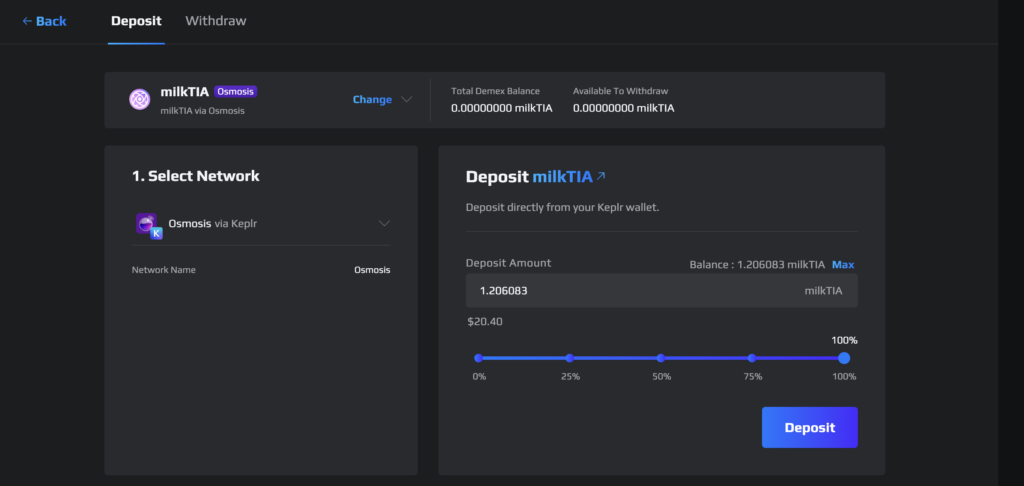

On this page, you can deposit your milkTIA from Keplr to Demex. Enter the amount you want to deposit, click deposit and approve the transaction. On this step, you’ll pay gas fees in OSMO.

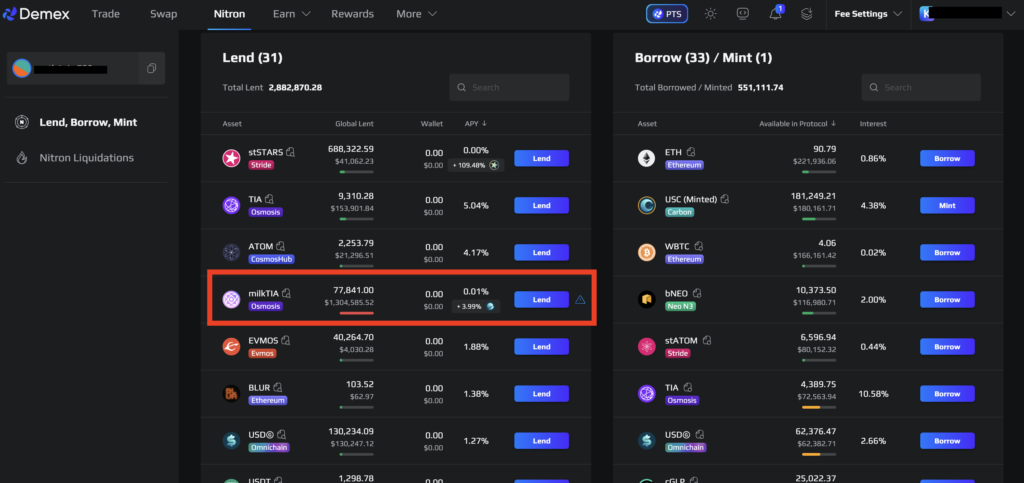

Now that you have your milkTIA deposited on Demex, click Nitron in the menu. On this page, scroll down until you see the lending pools. Click lend next to milkTIA.

If the pool is full, you’ll have to wait for people to withdraw before you can enter. Demex has announced plans to increase the pool capacity.

You can also lend other assets and trade on Demex to earn points.

Summary:

- Staking TIA (Celestia’s token) makes you eligible for airdrop opportunities from new protocols.

Dymension and Saga have airdropped tokens to TIA stakers.

The value of the airdrops compensate for the time lock-up of staked capital. - Staking TIA with a Validator:

- Send TIA to Keplr, Compass, or Leap Wallet from an exchange or swap ATOM for TIA.

- Open Keplr Dashboard, navigate to the staking tab, and choose Celestia as the chain.

- Select a validator with a commission of 5% or less and stake TIA.

- Be aware of the 21-day waiting period when unstaking.

- Staking TIA with Milky Way:

- Milky Way is a liquid staking protocol set to launch a token in 2024.

- Stake TIA with Milky to position yourself for the MILK airdrop

- Keep the 21-day waiting period in mind – you can withdraw immediately if you pay a fee

- Use the Milky Way app, connect your wallet, stake TIA, and approve transactions.

- Staking TIA with Demex:

- Demex is a decentralized exchange offering spot, perpetual, and futures markets.

- Demex is running a points system for their upcoming DMX token airdrop.

- If already staking TIA with Milky, lend milkTIA to Demex to accumulate points.

- Add the Carbon chain to Keplr, swap TIA for SWFH and OSMO for gas fees.

- Deposit milkTIA on Demex, lend in the Nitron pool, and earn points (gas fees paid in OSMO).

- Demex plans to increase milkTIA pool capacity.

How To Stake TIA & Stack Airdrops