Wondering how to stake AVAX? Staking AVAX involves locking your tokens in a smart contract in exchange for yield (payment) on your tokens. The yield comes from a portion of the transaction fees on the Avalanche blockchain or from a portion of fees generated by a specific protocol.

Because Avalanche is a Proof Of Stake (PoS) blockchain, there is a network of validators that secure the blockchain by staking their tokens on the Avalanche P-Chain. These validators work together to validate transactions and participate in governance on the Avalanche blockchain. Staking on the P-chain is a complicated method we’ll look at later in this article.

Another way to stake your AVAX is by using one of the many protocols on the Avalanche blockchain. Staking with smart contracts on the C-chain is a simple, user-friendly process that allows anyone to stake their AVAX. First, this article will cover simple staking methods on the Avalanche C-chain, then look at staking as a validator and the risks associated with staking in general.

How To Stake AVAX on BenQi

Step 1 – Click “Stake Now” On The BenQi Homepage

BenQi offers liquid staking, which allows people to use their AVAX while earning yield on their AVAX. Normally while earning yield, your tokens are locked in the contract. BenQi allows you to mint the sAVAX token, which gives you cash flow while still earning yield on your AVAX.

BenQI Liquid Staking is the first liquid staking protocol for Avalanche. Users stake AVAX with the BenQi smart contract and receive sAVAX – an interest-bearing version of AVAX. This allows users to earn rewards from BenQi and use their AVAX in any protocol they want.

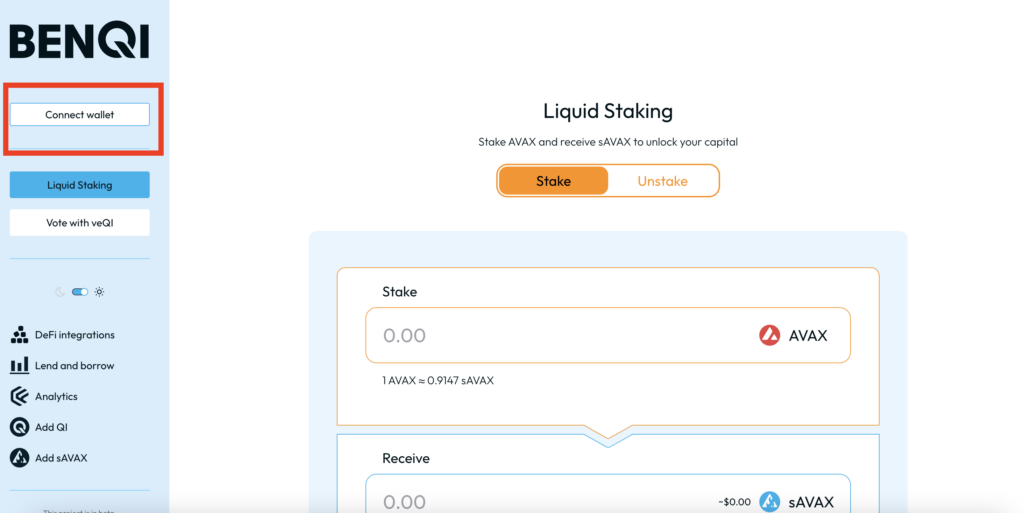

Step 2- Connect Your Wallet

Once you’re on the Liquid Staking page, connect your wallet.

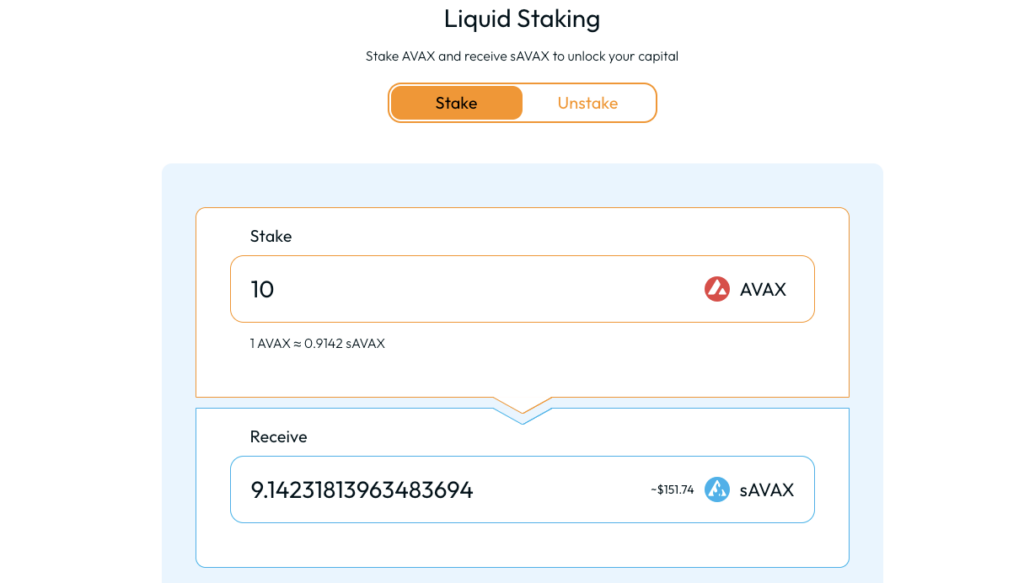

Step 3- Add your tokens to the contract

Now you can type in how many AVAX tokens you want to deposit into the contract. At the current rate, you’ll earn around 6% a year, and you’ll receive 0.914 sAVAX tokens for every 1 AVAX that you deposit.

Now that you’ve minted your sAVAX, you can use a DEX (like TraderJoe) to convert your sAVAX to your tokens. Effectively you can double up on your investment by buying something else with your sAVAX. Just don’t lose all your money, or you won’t be able to withdraw your AVAX tokens!

How To Stake AVAX Quickly

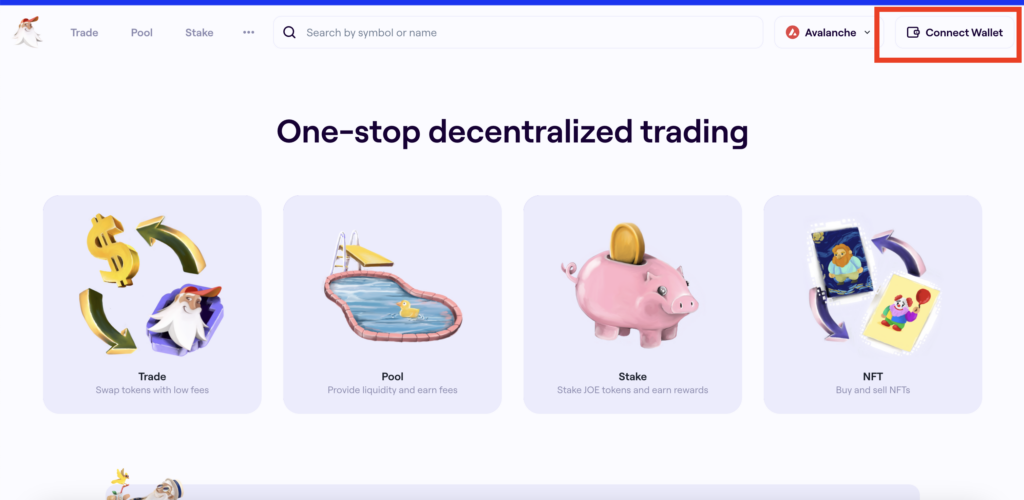

Step 1 – Go to TraderJoe

Now that you have sAVAX, you can double up on your yield with liquidity pools on Trader Joe. TraderJoe is the best place to stake AVAX for users looking for speed and convenience. TraderJoe is a decentralized exchange (dex) that allows users to swap a variety of tokens. TraderJoe also offers borrowing and lending services, the ability to earn from liquidity pools, and the ability to stake different tokens in exchange for rewards.

Once you’re on the TraderJoe home page, click connect wallet and make sure you’re on the Avalanche blockchain.

Step 2 – Click On Trade

The easiest way to stake AVAX on TraderJoe is by depositing your tokens in the AVAX/sAVAX pool. sAVAX stands for staked AVAX. sAVAX is minted (created) when users deposit their AVAX tokens in BenQi’s staking protocol. This allows users to earn yield from BenQi while still being able to use their sAVAX tokens in other protocols.

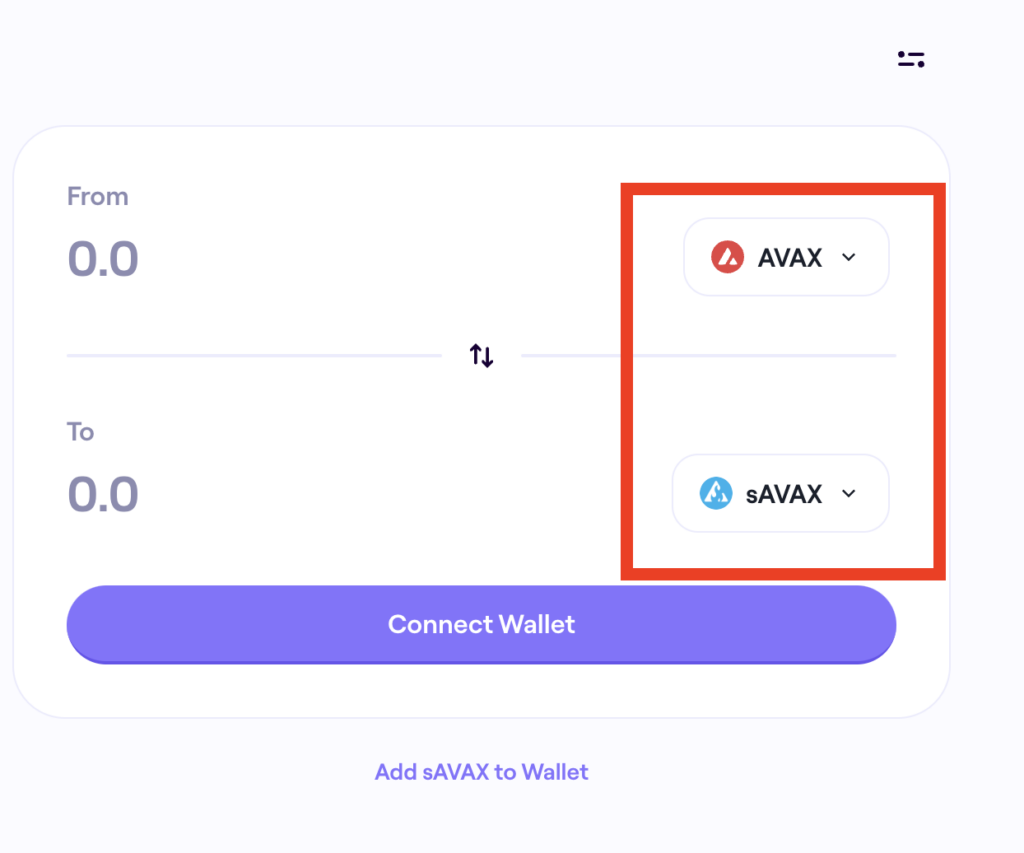

To enter the pool, we’ll need half of our assets in sAVAX and the other half in regular AVAX. For example, if you want to stake 20 AVAX tokens, convert 10 of them to sAVAX. Remember to keep enough AVAX in your wallet for gas.

Use the trade interface to convert half your tokens to sAVAX and keep the other half as AVAX.

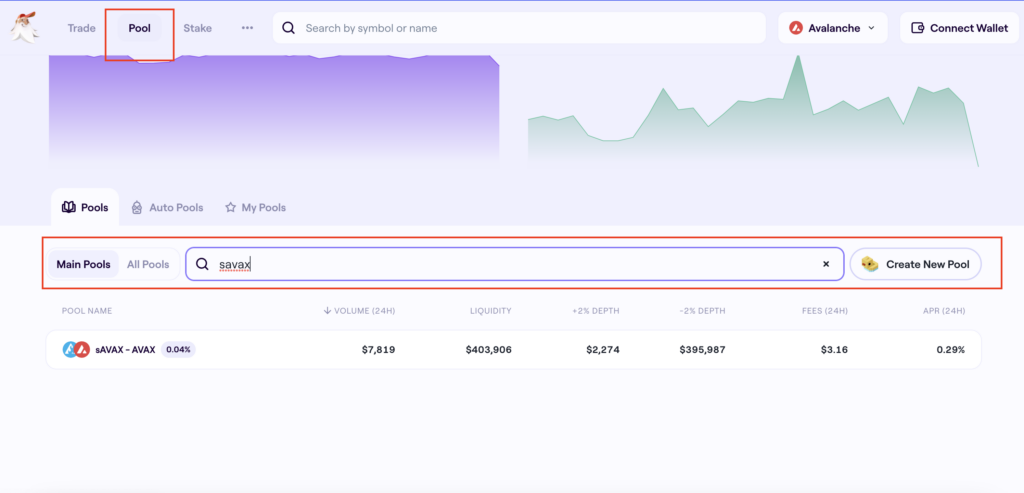

Step 3- Click on Pools In the Top Menu

Once you’re on the Pools page, scroll down to the search bar and type in sAVAX. Click on the pool to access the setup page.

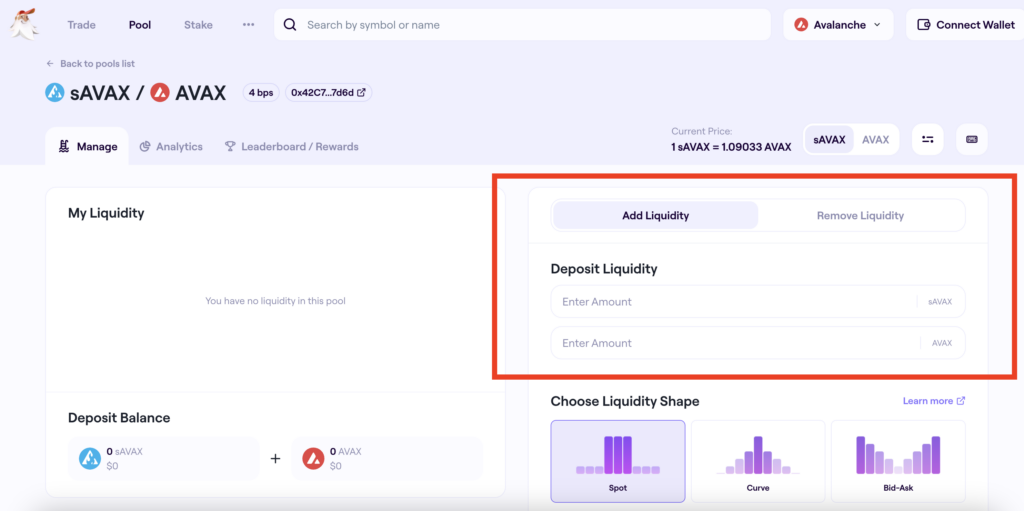

Step 4 – Enter your tokens

Once you’re on the pool page, enter the number of tokens you want to stake using the interface on the right. Both token amounts must be equal. You’ll need to approve the contract and sign a few confirmations in Metamask – then you’ll be able to stake your tokens in the contract.

To remove your tokens from the contract, simply click “remove liquidity” on the interface on the right of the screen and complete the approvals/confirmations until you can withdraw your tokens.

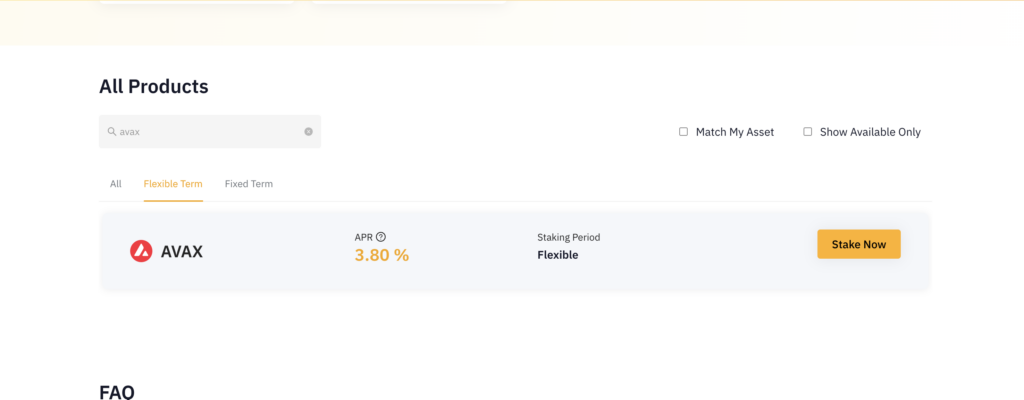

How To Stake AVAX On ByBit

ByBit is a centralized exchange that provides staking services for residents of certain countries. Keep in mind, unlike the methods described above, you’ll need to verify your identity with personal documents to stake your AVAX on ByBit.

Step 1 – Deposit Funds On ByBit

You can send funds from an exchange to your wallet on ByBit. Or you can buy AVAX directly through ByBit’s interface.

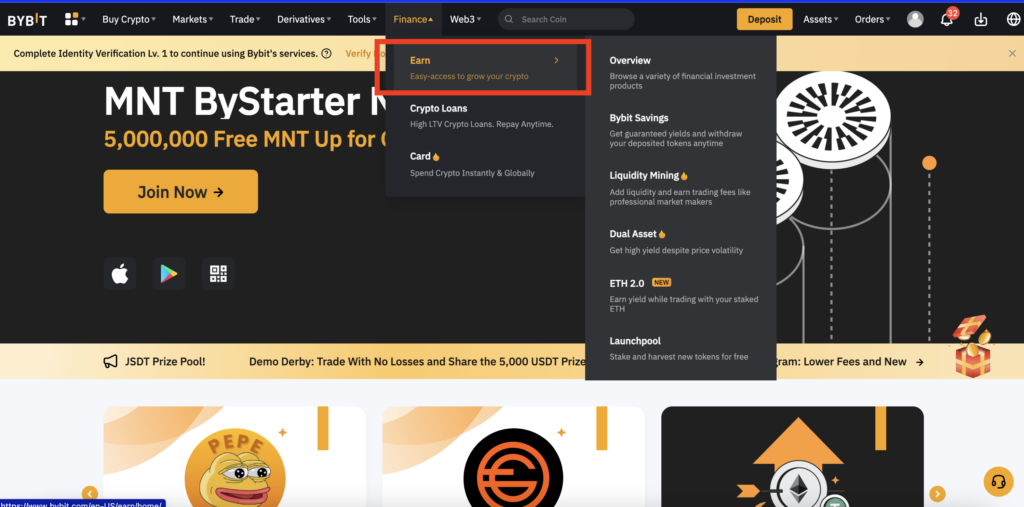

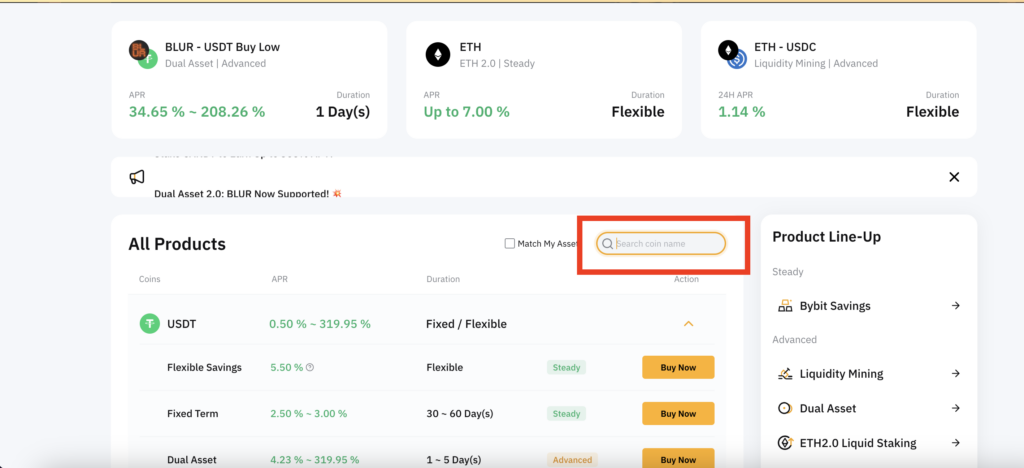

Step 2 – Hover Over The Finance Tab & Click on Earn

Clicking on Earn will take you to the page where you can set up AVAX staking.

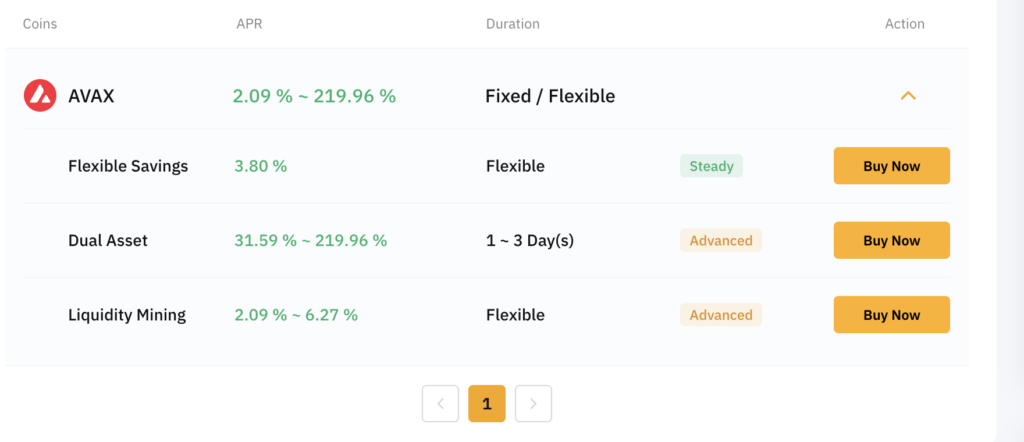

Step 3 – Type AVAX in the SearchBar

Step 4 – Choose Your Lending Product & Click Buy Now

Step 5 – Click on Stake now

Once you click on Stake Now, the ByBit interface will prompt you to deposit your AVAX tokens.

How To Stake AVAX On The P-Chain

Staking on the P-chain requires a more technical setup and is ideal for experienced users. Staking on the P-chain helps validate transactions and network activity on the Avalanche blockchain. You can become a delegator or a validator on the P-chain.

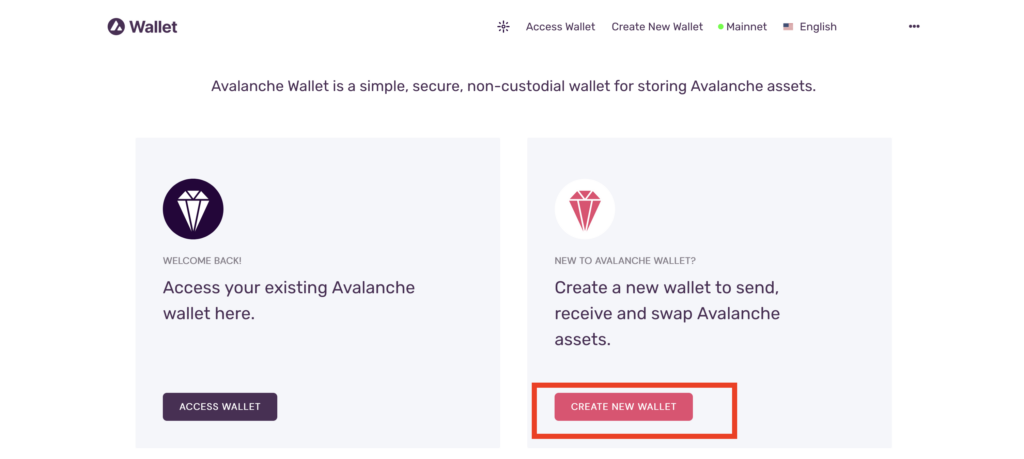

Step 1- Create a Wallet

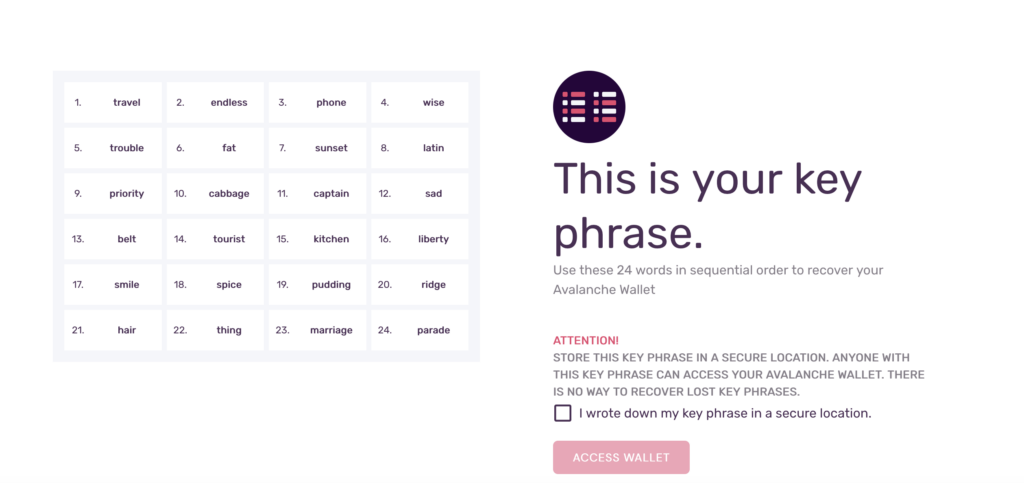

Start by creating a wallet using the Avalanche blockchain’s official wallet. Just like any WEB3 wallet, you’ll need to create a password and remember your key phrase.

Keeping your key phrase (with the words in order) is crucial in case you need to restore your wallet on another computer. The wallet interface will ask you for specific words from your key phrase to ensure you have it written down.

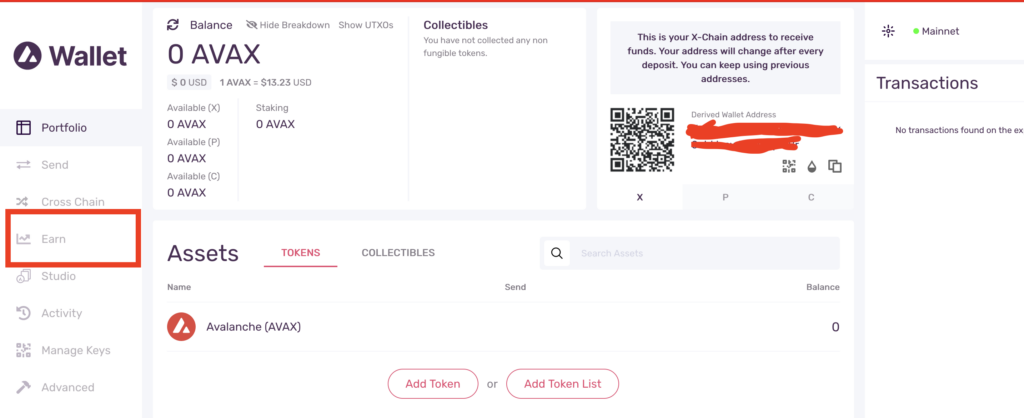

Step 2 – Click On The Earn Tab

Now that you have your wallet connected click on the earn tab.

Step 3 – Click “Add Validator” or “Add Delegator”

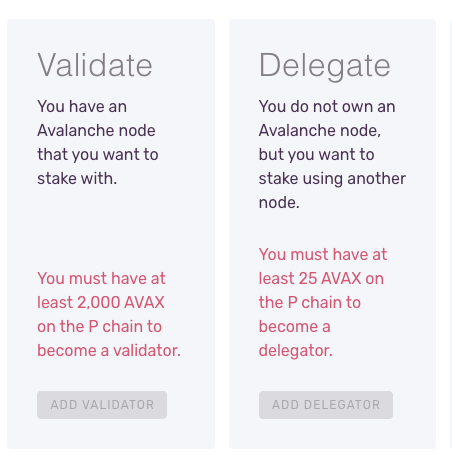

Using an Avalanche node to validate the blockchain requires a minimum of 2000 AVAX. Validators must also meet specific hardware requirements – having a computer with at least an 8-core CPU, 16GB of RAM, and 512GB of storage will help reduce your downtime as a validator. You can check out this article that covers in depth how validating works on Avalanche.

If you want to delegate (staking without running a node), you’ll need a minimum of 25 AVAX.

Risks of staking AVAX

Smart Contract Risks

Staking AVAX isn’t risk-free. When you stake with a decentralized provider like TraderJoe or BenQI, the main risk is smart contract issues. There’s always a chance the smart contract can get hacked or exploited, which would cause users to lose the tokens they have locked in the protocol.

When staking with a centralized provider like ByBit, you’re also at risk for hacks. Any hack that affects the provider can put your funds at risk since the funds are held in a centralized manner. Your identification documents can also be at risk when a hack occurs on a centralized exchange.

Validator Risk

If you’re tech-savvy enough to run a validator, it’s important to consider the risks of running a node. Any downtime in your computer hardware can cause you to lose out on potential rewards. Avalanche validators only receive rewards if their node is active more than 80% of the time. Again, you also need to keep 2000 AVAX locked to run a validator. Validating can be profitable, providing you know what to do on the technical side.

Liquidity Risks

Liquidity is another risk to consider when staking. If you earn a bunch of money paid out in a token with a small market capitalization, you may struggle to sell your coins when the time comes. You don’t have to worry about this with AVAX since AVAX has such a large market capitalization and deep liquidity. When staking other assets and earning other tokens as rewards, it’s important to consider how liquidity will impact your ability to take profit.

Lockup risks

Some staking protocols allow users to lock their tokens for a set period of time. This period can range from months to years. It’s important to consider what the overall state of the market will look like when you’re able to withdraw your locked tokens. Of course, no one can predict the future, but locking your tokens for years at a time when the market seems weak from a macro perspective is a bad idea.

On the other hand, locking your tokens for years when the market is headed towards a big run can result in a huge win. Not only will you stack up a large number of tokens, but the tokens will also appreciate in their USD value.

How To Stake AVAX – A Step By Step Guide With Pictures