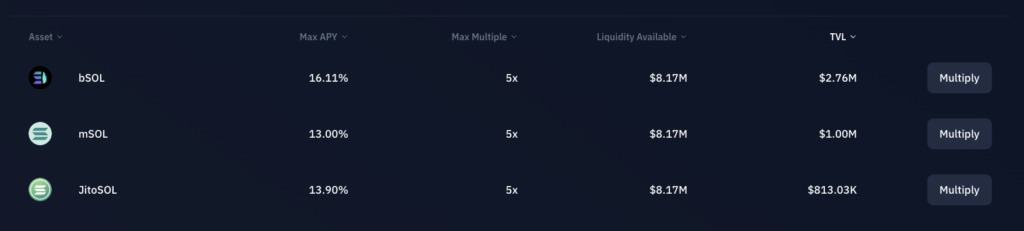

| Staking Protocol | APY On Solana | Airdrop? |

| JitoSOL | ~7.76% | Completed |

| MarginFi | ~7.83% | Pending |

| Marinade Finance | ~8.65% | Rumoured |

| Sol Lend | ~3.58% | None Announced |

| Orca | ~0.1% | Rumoured |

| Raydium | ~20% (30 day APR) | None Announced |

| Kamino Finance | ~12% – ~16% | Pending |

| Tensor | NFT Staking Only | Pending |

| Magic Eden | NFT Staking Only | Pending |

| Drift | 19% APR | Launching Soon |

If you’ve found your way to this article, you’ve probably realized the many benefits of staking your SOL tokens. While holding your SOL and waiting for price to go up, you might as well earn some yield on your portfolio. However, staking Solana requires finding a platform that offers a combination of security, reliability, and profitability.

Solana is a blockchain with a growing ecosystem and many new protocols that offer a variety of financial services. With an ecosystem growing as quickly as Solana, there are plenty of opportunities to add multiples to your portfolio. While looking for places to stake your Solana, you may even end up qualifying for an airdrop, which is something we talk about below.

Staking is when you “lock” your tokens in a protocol in exchange for a reward. Some protocols offer single-sided staking, where you stake SOL and receive a reward. There’s also liquid staking, where you receive a token (which you can spend elsewhere) while also receiving rewards on your initial SOL deposit. You can also provide Liquidity (an equal amount of 2 tokens) to a protocol to earn a yield on your SOL tokens.

In this article, we’ll look at 6 protocols that are candidates for the best place to stake Solana.

1. Kamino Finance

Kamino Finance is a new lending protocol on Solana with a variety of useful features.

Using Kamino’s Multiply feature is one of the best ways to earn on your SOL tokens. Check out this article here for a full breakdown on Kamino and how the Multiply function actually works.

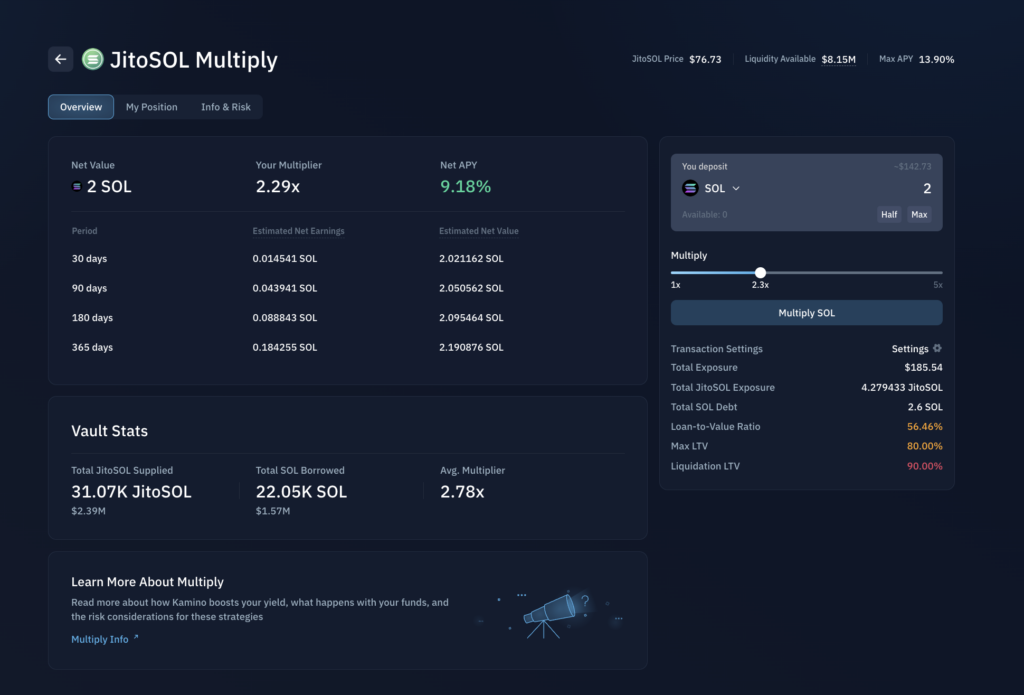

Using Multiply, you can deposit bSOL, JitoSOL, or mSOL. The protocol will automatically loop your SOL tokens depending on how much of a multiplier you selected. Depending on your multiplier, you can earn up to 16% APY on your Solana.

The Multiply function on Kamino also has a staking calculator that will show you how much you’ll earn over the next 30, 90, 180, and 345 days. Update the amount of SOL on the left side of screen to see your estimates change in real time. The Multiply function gives you access to more capital without having to open a loan, making it one of the best places to stake Solana.

2. Tensor

Looking to stake NFT’s on Solana? While it may not seem like it, NFT’s are basically just leveraged Solana positions.

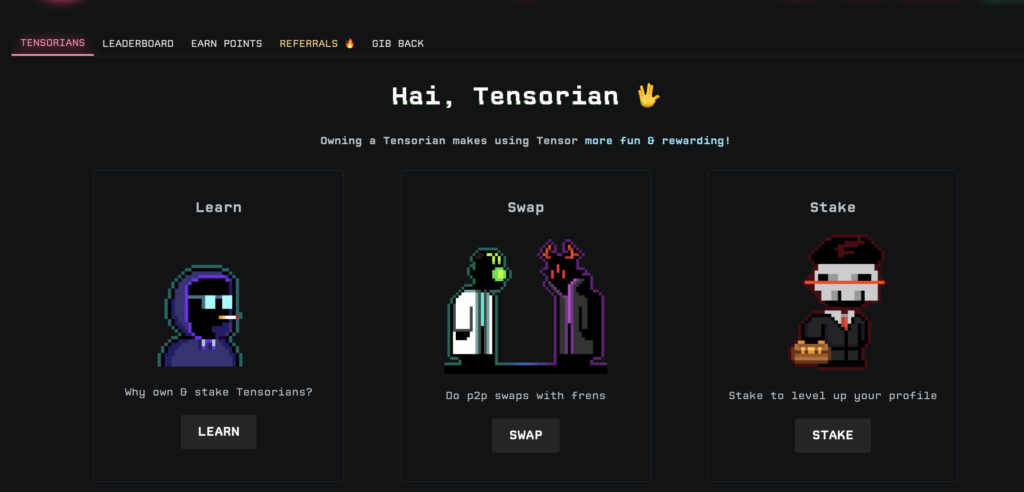

Tensor allows you to stake their premier collection, Tensorian’s. If you own one of these, make your way to the staking page and stake your NFT. Right now, 80% of the Tensorian’s collection is staked.

Staking your Tensorian will accelerate how quickly you earn points on the Tensor platform. Tensor has hinted at an airdrop in the future so earning points now through staking could be highly valuable in the future.

https://www.tensor.trade/rewards

3. Marinade Finance

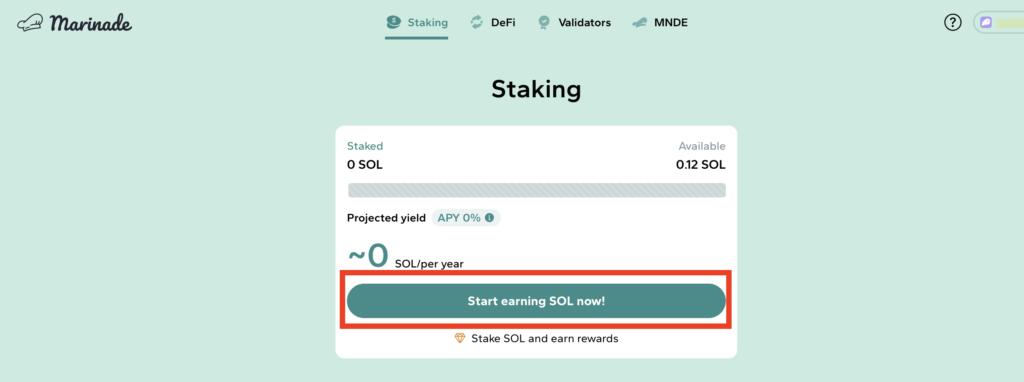

Marinade Finance is a liquid staking protocol on Solana. This means you can stake your SOL and earn yield while also receiving the mSOL token, which you can use on other protocols. Basically, you can double up on your SOL while still earning yield. When you deposit SOL into Marinade, you’ll get 1 mSOL for every 1.13 SOL deposited.

Currently, Marinade Finance is offering 7% apy for staking SOL. The 7% apy includes a 6% apy fee which is taken from the rewards you generate and not the base deposit. Liquid staking makes Marinade one of the best place to stake Solana.

At the time of writing, Marinade has $1.3 billion worth of assets locked in the protocol.

https://defillama.com/protocol/marinade#information

4. Drift Protocol

Drift Protocol is mainly known for their decentralized perps exchange but they also offer staking for people looking to earn on their SOL tokens.

Staking on Drift works by depositing your assets into an insurance fund which is used to keep Drift liquid. With your SOL deposited, you earn a portion of the fees from trades, borrows, and liquidations that occur on Drift. Drift gives 3% of the revenue pool to stakers. Drift is the best place to Stake Solana if you’re looking for more risk & more reward.

You can also earn yield on drift by depositing your SOL in the lend/borrow area. As a lender, you’ll earn 0.07% on your deposits and you can use your deposited SOL as collateral. This is a good option for stagnant capital that is otherwise just sitting around.

5. MarginFi

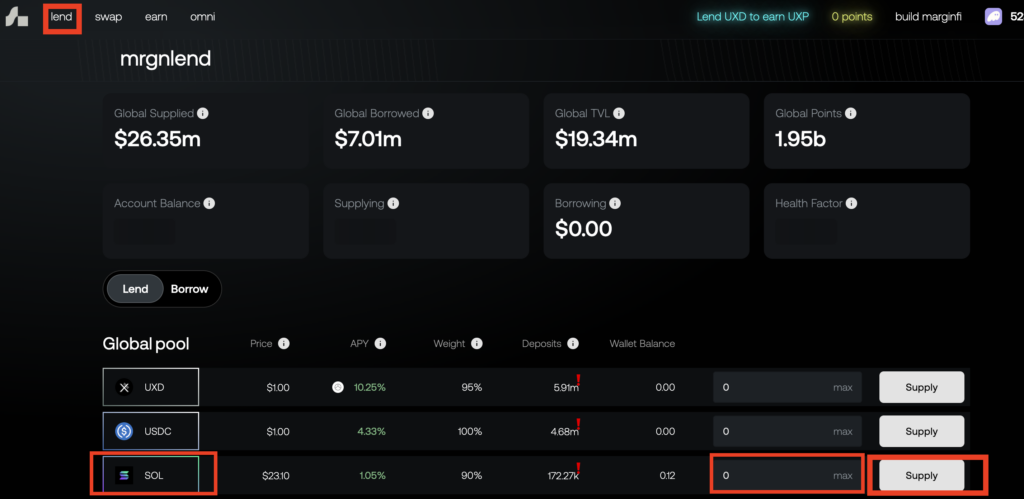

MarginFi is a lending protocol on Solana. At the time of writing, MarginFi has 19.3 million in total value locked in the protocol and is continuing to grow.

Start by connecting your wallet and navigating to the Lend page. You’ll need to sign a transaction in your wallet to continue beyond this point.

On the Lend page, you can supply Solana for 1.05% apy. The supply balance on MarginFI is used to facilitate lending and borrowing for users. Remember to read borrowing and lending guides before borrowing assets against your supply balance. You can earn yield just by depositing SOL; borrowing isn’t a necessary step.

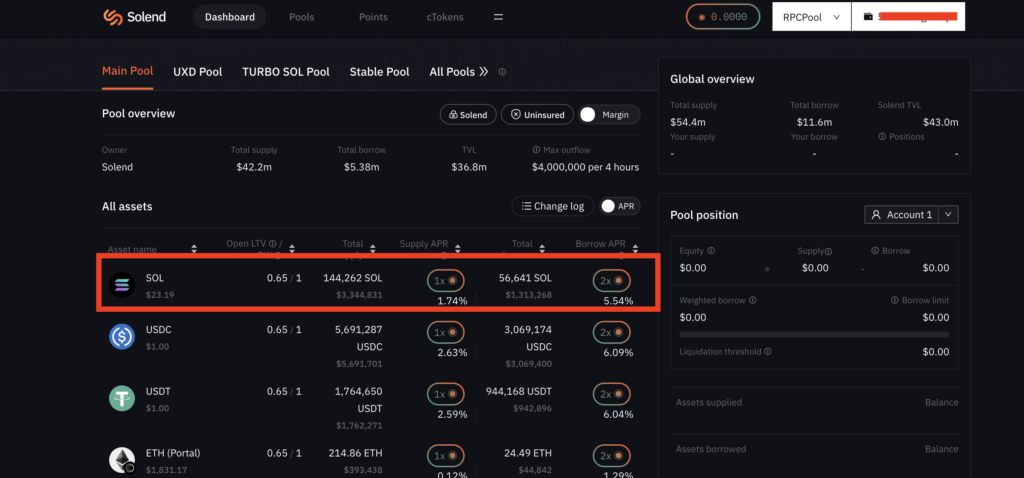

6. SOLend

With $120 million in assets locked, SOLend is another protocol you can use to stake your SOL.

On the main page, click on the Solana pool to supply SOL tokens. SOLend offers 1.74% APR in exchange for your tokens.

You can read more on the SOLend protocol and general lending risks here -> https://docs.solend.fi/permissionless-pools/risks

7. Orca Whirlpools

Orca is a protocol built around a Concentrated Liquidity Automated Market Maker. Through the Orca protocol, you can become a liquidity provider to earn rewards on your Solana.

Orca has a variety of Solana pools, including mSOL/SOL and Solana paired with stablecoins.

If you’re not familiar with providing Liquidity, you’ll need to first choose a pool, then deposit equal amounts of assets into the pool. If you wanted to enter the mSOL/SOL pool, for example, you would need to deposit 1 mSOL and 1 SOL, and Orca will pay you 0.016% every 24 hours. The rewards are based on trading fees which can fluctuate violently, so rewards are calculated on a 24-hour basis.

https://v1.orca.so/liquidity/browse

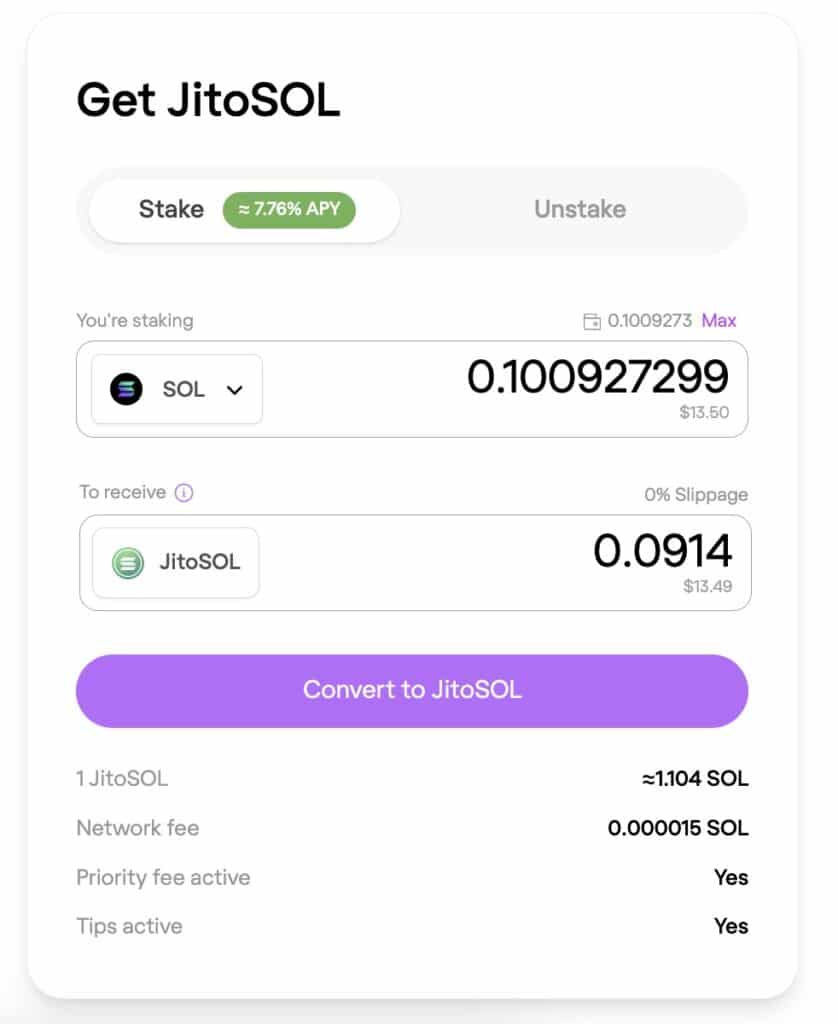

8. JitoSOL

The JitoSOL Protocol uses regular staking rewards and Maximum Extractable Value (MEV) to increase the value of the JitoSOL token. These rewards are generated from transaction activity on Solana.

While JitoSOL increases in value, you can use JitoSOL in other defi protocols, essentially allowing you to double your capital. For this reason alone, JitoSOL is one of the best places to stake Solana.

The JitoSOL protocol encourages multiple stake pools to exist, which contributes to the decentralization of Solana. These stake pools each consistent of multiple validator nodes, allowing for a less centralized blockchain.

When you deposit SOL in the JitoSOL protocol, you recieve less JitoSOL in return. However, because JitoSOL is always increasing in value, you’ll be able to redeem more than what you deposited.

Jito completed one of the most successful airdrops on Solana by evenly distributing the JTO governance token among early user.s

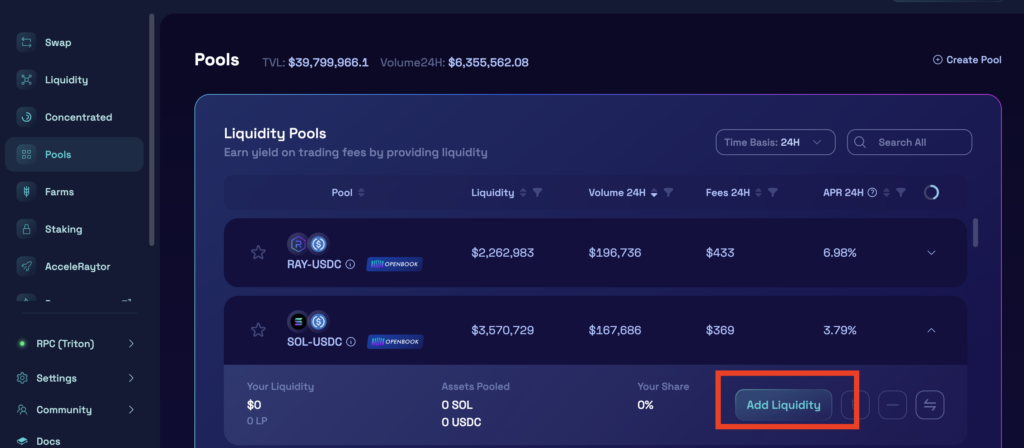

9. Raydium

Raydium is an order book protocol on Solana. With Raydium, you can execute swaps, provide Liquidity, and farm token rewards. Using Raydium’s SOL/USDC pool, you can earn 3.79% APR (based on the last 24 hours)

Click Add Liquidity to get started. On the next page, you can deposit equal amounts of SOL and USDC. Remember to leave enough SOL in your wallet for transaction fees.

At the time of writing, Raydium has $58 million in assets locked in the protocol.

Add Risk To Maximize Your Earnings From Staking

Here's a risky strategy you can use: deposit SOL into JitoSOL so you can earn ~7% on your initial deposit. Then you can take your JitoSOL, swap into SOL, and enter a long position on Drift Protocol. Or you can deposit your borrowed SOL into Kamino and use the multiply function to loop & stake your SOL. You can also add the borrowed funds to a SOL LP position. These are a few examples of how you can use liquid staking to multiply your earnings.

While browsing protocols looking for the best place to stake Solana, don’t let greed cloud your thinking. It’s essential to double and triple-check that you only interact with safe, reputable protocols. Make sure you use strategies that align with your risk tolerance. Finding a safe protocol to stake your Solana is one of the easiest ways to earn extra money on tokens you already hold.

Best Place To Stake Solana Summary:

- The best place to stake Solana will prioritize security and reliability while offering profitable opportunities for users.

- Staking involves locking tokens for rewards, with options like single-sided staking and liquid staking.

- Providing liquidity also allows you to earn yield on SOL tokens.

- JitoSOL:

- Combines validator rewards with Maximum Extractable Value (MEV) rewards to boost value of the JitoSOL token.

- Holding JitoSOL allows you to use capital in other DeFi protocols

- You earn points daily for holding and using JitoSOL.

- MarginFi:

- New lending protocol with over 19.3 million total value locked.

- Offers 1.05% APY for supplying SOL.

- Supports lending and borrowing.

- Marinade Finance:

- Liquid staking protocol providing mSOL tokens alongside staking rewards.

- Offers 7% APY for staking SOL.

- $517 million assets locked in the protocol.

- SOLend:

- $120 million assets locked in the protocol.

- Offers 1.74% APR for supplying SOL.

- Risks outlined in SOLend protocol documentation.

- Orca Whirlpools:

- Utilizes Concentrated Liquidity Automated Market Maker.

- Provides liquidity rewards for staking SOL.

- Choose from the many pools to earn, including mSOL/SOL and stablecoin pairs.

- Raydium:

- Order book protocol on Solana offering swaps, liquidity provision, and farming.

- Earns 3.79% APR in SOL/USDC pool.

- $58 million assets locked in the protocol.

- Kamino Finance

- Increase your stake size with Multiply

- Airdrop completed

- Thoroughly research every protocol before connecting your wallet.

- Don’t let greed cloud your judgment – only use strategies that align with your risk tolerance.

- Tensor allows you to stake NFT for points

- Read Tensor docs for risks on staking NFTs

- Providing liquidity or staking JitoSOL in Orca, Raydium, Solend, Margin.Fi, or Drift allows you to earn between 1.5x to 3.5x more JitoSOL points per day.

Best Place To Stake Solana – 9 Profitable Options