They say always dig a well before you get thirsty, so in an attempt to quench my thirst, I logged into Phantom, made my way to Kamino, and started adding liquidity. Not only does Kamino Finance have a strong team, but there are also rumors of an upcoming airdrop. Your future self just may thank you for taking the time to dig your well.

Now, in crypto, lending protocols are a dime a dozen. Every blockchain has its own version of a lending protocol where users can earn in a variety of ways. These protocols all have liquidity pools, lending/borrowing functions, and incentives to encourage users to provide liquidity.

Kamino Finance offers all of these functions in addition to a few stand-out features we’ll look at in this article: kTokens, Multiply, and their Risk Dashboard.

kTokens = LP As Collateral

kTokens are one of the most intriguing things about the Kamino protocol. kTokens are tokenized representations of your liquidity provider (LP) positions.

Kamino allows you to use kTokens as collateral for borrowing. So while you’re earning yield for providing liquidity, you can also use your kTokens to borrow more capital, giving you more liquid assets to work with.

kTokens effectively allow you to add leverage to your LP positions. With the newly borrowed funds from your kToken collateral, you have many options:

- Use the borrowed assets to increase your LP position.

- Use the borrowed assets in a different protocol (Go long/short on Drift, add to different liquidity pools, Stake for JitoSOL or mSOL, etc)

- Keep cash on hand to increase your positions/rebalance your portfolio during down periods in the market.

- Use the borrowed assets to hedge against your LP position.

Keep in mind, the value of your kTokens is tied to the value of the underlying assets. Meaning, if you create kTokens while providing liquidity to the SOL/JitoSOL pool, and SOL goes down 10%, the value of your kTokens will also decrease by 10%. Changes in price will also impact your collateral-to-debt ratio if you borrowed against your kTokens. If you have open borrow positions, you’ll need to add more collateral to avoid partial or full liquidations.

Multiply & Emode

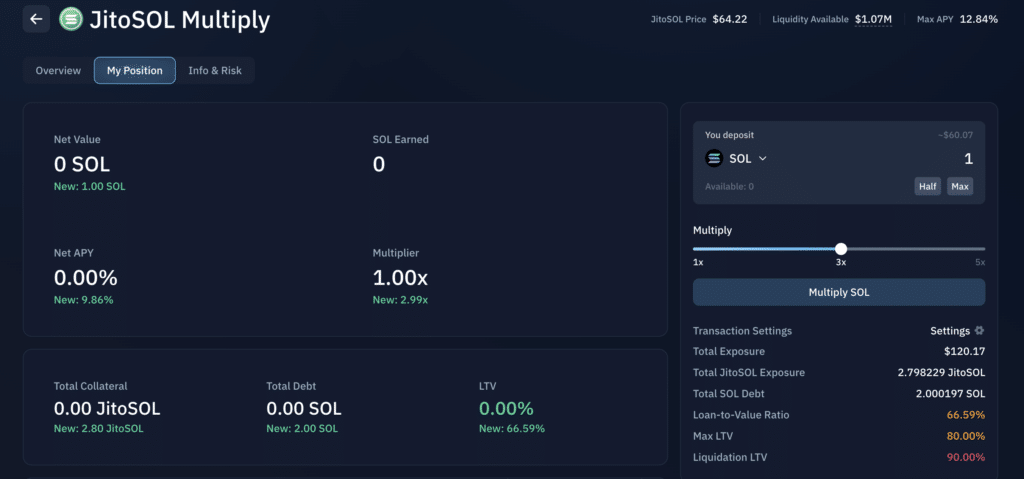

Kamino is on a mission to make single-sided Solana staking great again with Multiply & eMode. Multiply works by allowing you to increase your exposure to yield-bearing assets (ex, JitoSOL, mSOL) by borrowing the underlying asset (SOL). The Multiply function is another way Kamino allows stakers and liquidity providers to add leverage and increase available capital.

The multiply function uses eMode to increase the available loan-to-value (LTV) ratios between assets. For example, typically, the JitoSOL/SOL vault has an LTV of 75% – with eMode, this increases to 90%.

When you enter a Multiply pool, the borrowed funds are automatically added to your staking position. Before depositing, you can choose between a 1x to 5x multiplier – a higher multiplier = more risk. The dashboard on the left side of the screen shows how real-time changes to your multiplier and collateral affect your position. The green numbers represent the changes if you proceed with the action.

Remember, the more of your LTV that you use, the more your risk of liquidation increases. It’s essential to keep an eye on market prices so you can add collateral when necessary. If you’re maxing out your LTV with the multiply function, sharp moves in the market can cause partial or full liquidations.

Risk Dashboard

As far as transparency goes, Kamino may be leading the industry.

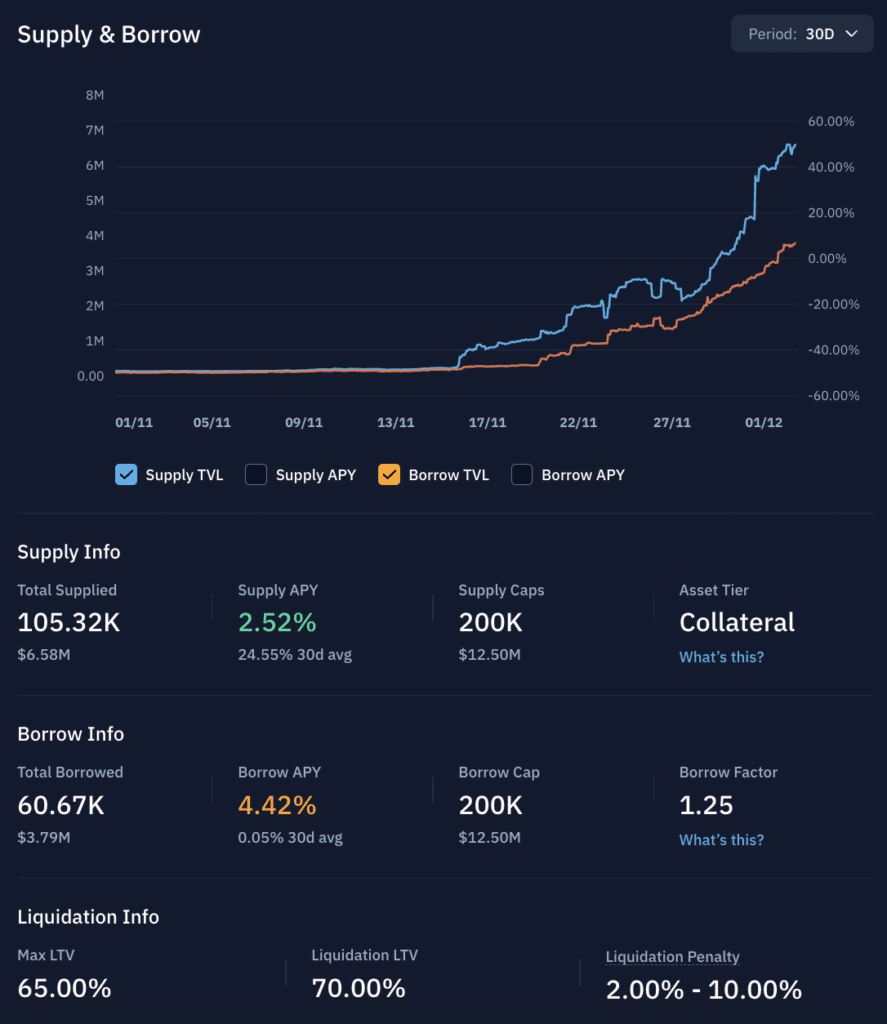

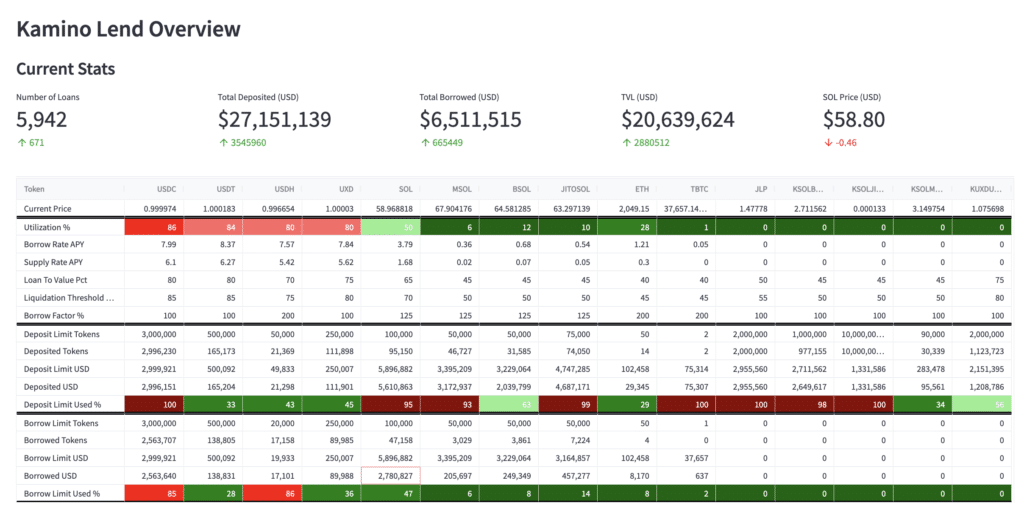

Kamino’s risk dashboard provides a detailed look at what’s actually going on in the Kamino protocol. This dashboard allows you to quickly check new pool caps and asses risk based on liquidity, LTV, and utilization rates. You can also monitor total deposits and borrows for every token. If you’re having trouble adding to a pool on Kamino, check the risk dashboard to see newly updated pool caps.

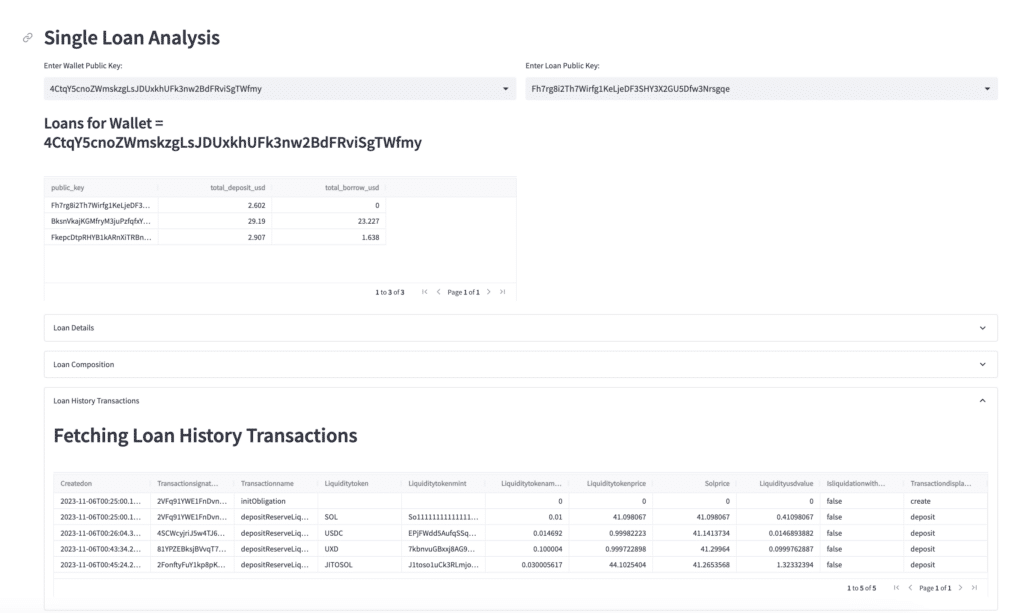

The Single Loan Analysis page makes it easy to examine your wallet history and current loan status. On this page, you can see your transactions and your loan composition.

If you’re into tracking whale wallets, this can be a powerful tool. You can use the leaderboard page to find the top lenders and top borrowers using Kamino and analyze their activity with the Single Loan Analysis page. This is a good way to study the behaviour of wallets at the top of the airdrop points leaderboard.

If you’ve got a big brain, the price shock analysis page can keep you busy for a while. On this page, you can visualize different scenarios based on sudden changes in asset prices. The price shock analysis allows you to apply historic event price shocks to the current token supply or asses risk scenarios for individual tokens.

Points = Airdrop?

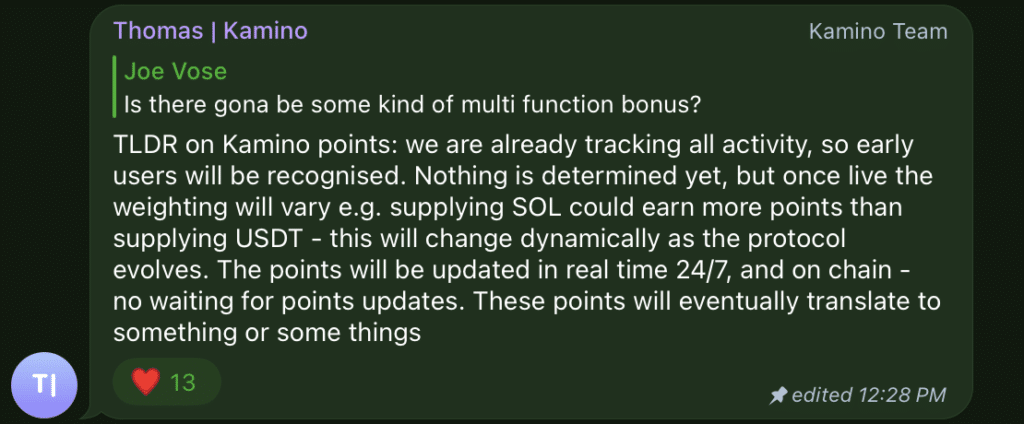

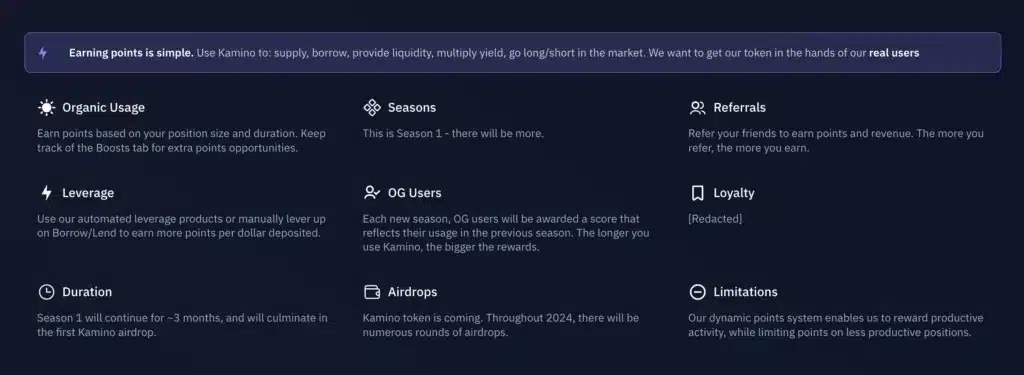

Update March 2024: Kamino has confirmed and launched its points program, which they will use to distribute the KMNO token to users. The actions discussed in this article will help you build up points, and you can learn more about how to earn points here.

Rumors are flying, and Kamino has hinted at the possibility of an airdrop. Like many other protocols on Solana, there’s a high likelihood that they use some kind of point system to decide how to allocate the airdrop.

With any points system, certain actions are going to have more value than others. Based on other airdrops by similar protocols, here’s my guess on which actions will end up generating the most points:

Providing liquidity

Protocols with deep liquidity are rare, so encouraging people to add liquidity is always a priority. There’s a good chance you’ll earn more points for providing liquidity for scarce assets or stablecoins. SOL-USDC, JitoSOL-USDC, mSOL-USDC are good options to start with. Providing liquidity for SOL and other liquid staking options (mSOL, JitoSOL) may also be a good idea. You can use the risk dashboard to asses which assets are most scarce in the Kamino protocol.

Transaction Volume

Building up transaction volume and using the protocol naturally are essential factors for getting listed for an airdrop. Try out all the functions on Kamino to build volume and leave your footprint all across the Kamino ecosystem. If you don’t feel comfortable taking on debt positions, you can open a position for a small amount ($10) or open a position and immediately repay. Both opening positions and closing positions count towards your transaction volume.

Summary

This article just scratched the surface of Kamino Finance. Kamino also has a unique liquidation system that involves partial liquidations, which I recommend reading about here.

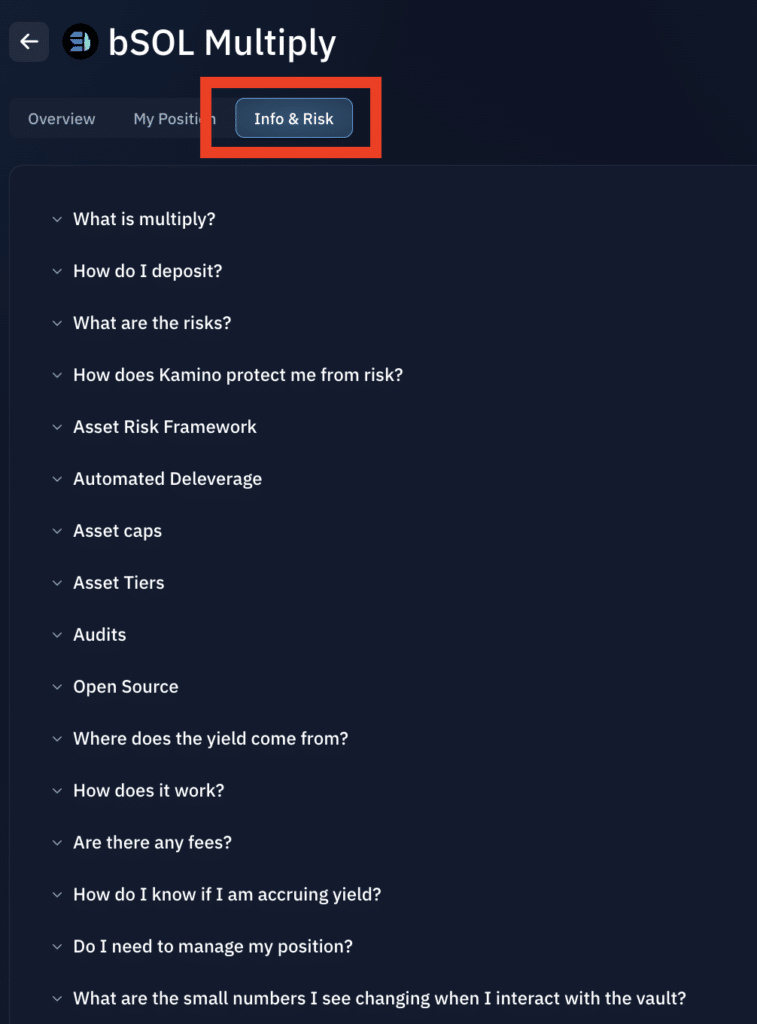

With any product you use on Kamino, you can click on the “info & risk” tab to get more information about how everything works. I highly recommend checking out this tab, which will help you understand how price fluctuations impact your open positions.

- Kamino Finance is a crypto protocol with lending, borrowing, staking and liquidity pool features.

- kTokens, Multiply, and a transparent Risk Dashboard are unique offerings that help Kamino stand out

- Use kTokens for LP Leverage:

- kTokens represent your liquidity pool positions.Use kTokens as collateral for borrowing, adding leverage to your positions.

- Borrowed funds can be used to enhance/manage LP positions or in other protocols.

- Multiply & eMode:

- Multiply increases your exposure to yield bearing assets by borrowing underlying assets.eMode boosts loan-to-value ratios, providing access to more liquidity.

- Users choose a multiplier (1x to 5x) but need to be aware of increased liquidation risk.

- Risk Dashboard Transparency:

- Kamino’s Risk Dashboard allows you to check pool caps & assess risk based on liquidity, utilization rate, and LTV.

- The Single Loan Analysis page is a powerful tool for tracking wallets and visualizing loan status.

- Points System and Airdrop Rumors:

- An airdrop has been confirmed with a points system.Actions like providing liquidity and generating transaction volume likely earn more points.

- Read these guidelines to learn how to maximize your airdrop points

- Transaction volume is crucial for airdrop eligibility.

- An airdrop has been confirmed with a points system.Actions like providing liquidity and generating transaction volume likely earn more points.

- Kamino has a unique liquidation system involving partial liquidations.

- Explore the “info & risk” tab for detailed information on how each product works.

Getting The Most Out Of Kamino: Unique Features & Airdrop?