VWAP (Volume Weighted Adjusted Price) shows you the average price of an asset adjusted for the amount of volume traded on the asset. This information is a useful tool you can use to enhance your trading strategies. Because volume is constantly changing, VWAP is most useful on lower timeframes to help you navigate trends and ranges. Download and study the VWAP Trading Strategy PDFs in this article to gain a better understanding of how to use VWAP.

VWAP Trading Strategy 1

This valuable thread from CryptoBully mainly focuses on using Anchored VWAP to identify potential entries on low time frames. This strategy works best on 1m and 5m charts.

Basically, CryptoBully’s strategy involves Anchoring VWAP to swing highs, swing lows, and the beginning of ranges.

Anchoring VWAP to these areas makes identifying potential entry/exit points easier during trends or ranges. VWAP works best at these key inflection points since they are generally where the most volume is being traded. Check out these tweets here.

By looking at how price reacts to the VWAP, you can identify potential trend failures or continuations before they happen. The reaction can also signal profitable entries. In the above image, you can see how anchoring VWAP to a swing high helps identify the continuation of the downtrend while also highlighting potential short entries when the price rejects from VWAP.

When anchoring VWAP to a candle open, pick a key candle, such as the candle before a breakdown or the candle before a breakout.

VWAP Trading Strategy PDF

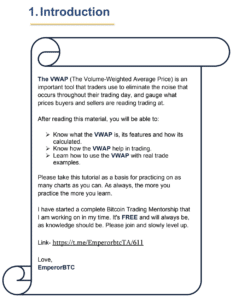

This PDF from EmperorBTC gives a high-quality overview of both session VWAP and anchored VWAP.

The PDF starts with a general explanation of VWAP, how it’s calculated, and how traders can use it as a tool. EmperorBTC then goes into how to use session VWAP and anchored VWAP and how to identify ideal situations for using both tools. EmperorBTC also includes an excellent overview of when it makes the most sense to use VWAP.

This is an excellent VWAP trading strategy PDF if you’re new to the definitions and theories that surround trading. In this PDF, EmperorBTC also includes scenarios where VWAP can be useless. Many new traders get trapped into blindly following an indicator, so learning about indicators from all aspects is essential.

https://drive.google.com/file/d/1jcZKA_e7OZ_EOwOZDzq7LSyL0ne6PosQ/view

VWAP Trading Strategy PDF 2

This is another PDF from EmperorBTC that focuses on Anchored VWAP.

In this PDF, you can expect a detailed overview of the anchored VWAP tool, how to set it up, and how to use the tool in both bullish and bearish situations.

The examples in this PDF will help with your execution while using anchored VWAP. Using the theory described in the PDF, you’ll become better able to use anchored VWAP to identify trend continuations.

https://drive.google.com/file/d/12wcunsCMh_hrdq_9gArioHuJSV5nLkFJ/view

5 Ways To Use VWAP

During Trends

VWAP is a great tool when prices are moving strongly and consistently in one direction. When price is consistently above or below VWAP, it usually indicates a strong trend. However, if price chops around the VWAP, it indicates weakness or can signal the end of a trend. The anchored VWAP trading strategy PDF outlines this concept perfectly with examples in image form. Anchoring VWAP to key highs and lows will give you more clarity during trends.

In Ranges (chop)

When the market is moving sideways, most people get chopped up. VWAP can help you navigate tight ranges since you can assume the VWAP is the fair value of the asset. If price is frequently chopping around VWAP, this indicates that there’s no real trend or strength in the market.

Instead of getting chopped up, you can wait for a better entry. In ranges, you’ll need to use VWAP in combination with other tools to identify the beginning of a new trend. You can also use VWAP to help you scalp both sides of the range. Or you can wait for the new trend to start and use the swing high/swing low strategy.

During Opening & Closing Hours

Traders also use VWAP to navigate the opening and closing hours of trading sessions. “Kill Zones” are the times of the day when different markets worldwide open for trading. When these markets open, they inject liquidity into the market, which creates volatility. The three main “kill zones” are Asia (1900 – 2300 EST), London (0200 – 0400 EST), and New York Kill Zone (0830 – 1030 EST.)

VWAP helps traders sharpen their execution by gauging the average price during these volatile periods. The injection of liquidity during these times can cause prices to act significantly differently compared to recent intraday trends. In addition to VWAP, you can use different aggr trade templates as additional confluence when trading these kill zones.

When You Have Large Size

VWAP is also useful if you’re trying to move large amounts of money in a market with thin liquidity. VWAP is where the most liquidity should be in the market. By making your buys and sells at the VWAP price, you can limit how much slippage you incur.

If you find yourself trading altcoins, you may struggle to get in and out of your position without taking significant hits on slippage. Layering limit orders around the VWAP will help you enter and exit at as little cost as possible.

On High Time Frames

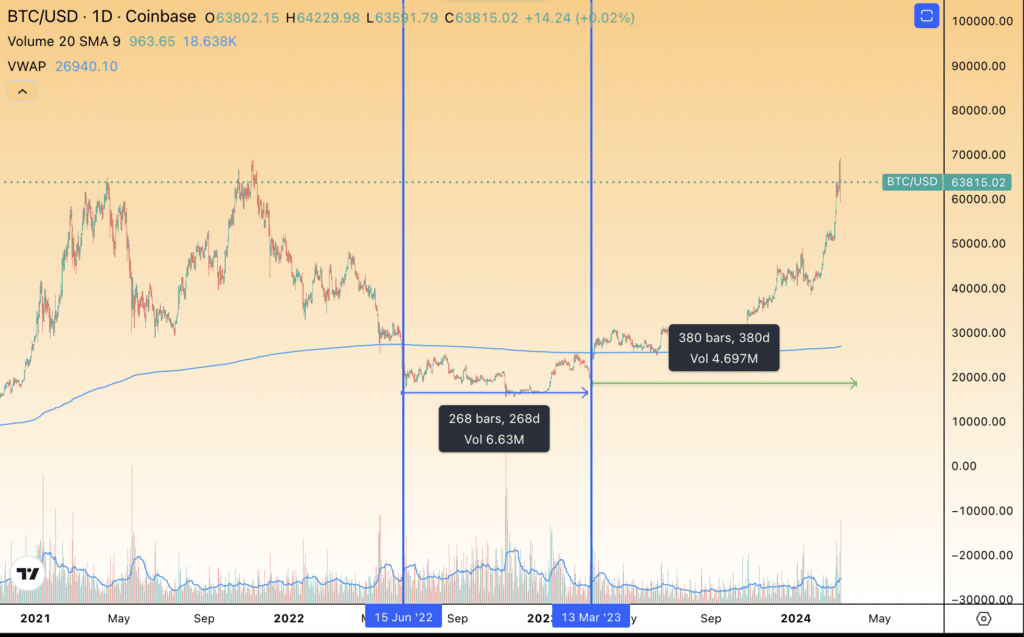

VWAP is also useful on high time frame charts (12 hour, daily, weekly, etc), especially if you have the fixed VWAP indicator. Since VWAP follows where the most volume is traded, you can use it to gauge the current trend and identify high time frame levels that should be respected.

For example, if price makes a new high, then starts chopping in a range while also accepting under the VWAP on a high time frame, you can assume the trend is shifting to bearish.

If price makes a new low, starts to range, then reclaims VWAP on a high time frame, you can assume the trend is starting to switch bullish.

With the fixed VWAP indicator you can choose specific highs/lows to start calculating VWAP from which will help you better follow the trend and identify key levels.

In the image below, Bitcoin went sideways for 268 days while consolidating under the VWAP. After reclaiming the VWAP, bullish price action continued for 300+ days. Using the fixed VWAP indicator from the 2021 top will give you a more accurate VWAP.

Intraday Mean Reversion Trades

Traders also use VWAP to try and catch mean reversion trades. Whenever price moves away from the VWAP significantly, it usually signals an overextended move. The VWAP now becomes a potential target for price to correct back to, also known as mean reversion. This type of strategy works best on low time frames.

Summary

VWAP is a powerful tool that’s best used in combination with other trading tools and theories. The theories and strategies shared in this article will help you use VWAP to intentionally see certain things in the market. Using VWAP with intention will get you the best results compared to just blindly following VWAP or trying to use it as support or resistance.

As you make your way through the VWAP trading strategy PDF, you’ll begin to understand how time frames affect VWAP and how VWAP has the potential to lag behind in fast-moving markets. Learning the nuances of VWAP will help you make better decisions. The strategies outlined in this article and the downloadable PDFs will help you add VWAP to your existing trading tools and skills.

VWAP Trading Strategy PDF – Download 3 Proven Strategies