“But when you think you’re safe is precisely when you’re most vulnerable.” – Seven Samurai

Selling for a 20% gain in crypto often leaves you in crippling pain when the token goes up another 140%. At the same time, holding a token with no end in sight is how you end up bagholding and roundtripping your profits.

Identifying market conditions takes some of the guesswork out of crypto. Market conditions influence high time frame trends. You could say market conditions define the direction in which prices move in the long term. Getting in sync with the current market conditions helps you know when to take risk and when to sit out.

So, how do you evaluate the state of the current market? What signs are bullish, and which ones are bearish? In this article, we’ll look at 5 factors that will help you diagnose current market conditions.

Follow Weekly Trends

Markets move with high time frame trends, so looking at monthly and weekly charts can give you insight into current market conditions. You can expect the market to follow the general trend of the major crypto tokens – BTC, ETH, SOL.

A bullish weekly trend has higher lows defended and followed up with higher highs. A bearish weekly trend would have lower highs defended and followed by lower lows.

You can use moving averages on weekly charts to visualize the current trend. The 12 EMA is calculated based on the average closing prices over the last 12 weeks, which makes EMAs responsive to changes in trends.

When price is consistently getting rejected by the EMA, the trend is bearish. Looking for weekly candles to start closing above the EMA will help you identify a shift into a bullish trend.

What’s The State Of The TOTAL3 Chart?

The TOTAL3 chart shows the combined market cap of all tokens, excluding Bitcoin and Ethereum. TOTAL3 makes it easy to visualize how money is moving around in altcoins.

Using simple support/resistance lines on the TOTAL3 chart can help give you context to market-wide pullbacks and potential areas for market tops. For example, if the entire market pulls back, but TOTAL3 makes a higher low and maintains a bullish structure, you can reasonably expect bullish conditions to continue once the pullback is over.

When TOTAL3 is trending strongly in one direction, you have a clear indicator of the overall trend of the market. When TOTAL3 is accumulating, you can look for buying opportunities in altcoins. When TOTAL3 is approaching resistance, it’s time to start being careful.

Don’t get lost in the details on the TOTAL3 chart. All you need to look at are daily and weekly trends. Are higher lows being followed up with higher highs? Are lows defended, or is the price retesting these lows? Analyzing this chart will give you a better context for navigating crypto.

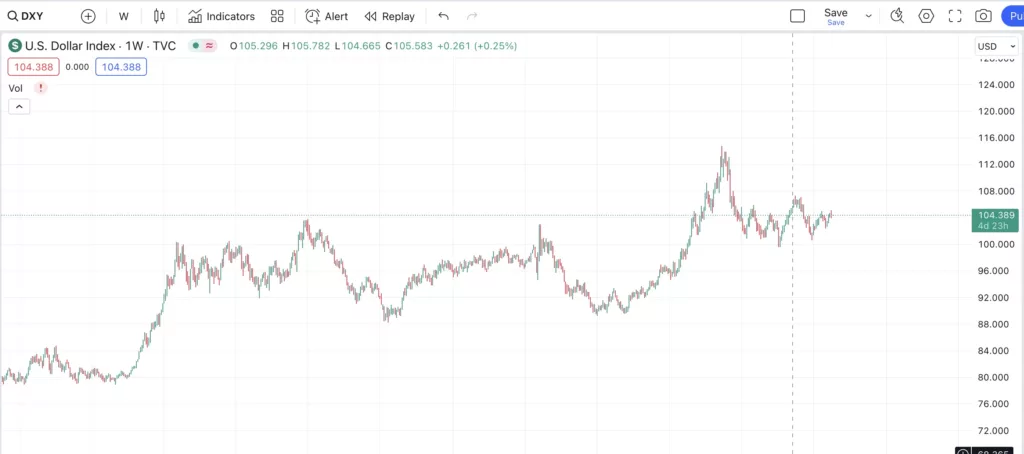

Look To US Dollar

Another way you can evaluate current market conditions is by looking at the US dollar index. The US dollar index (DXY) measures the value of the US dollar vs multiple foreign currencies such as the Yen, the Canadian dollar, the Euro, and more.

When the market is bullish, and participants are ready to take on more risk, the DXY begins to fall. Fewer people hold US dollars because they figure they can make more money in stocks, crypto, and other areas.

When the market is bearish, people look for safety and return to the US dollar. This causes the DXY to rise.

Doing some a alysis on the DXY chart can help you evaluate current conditions. If DXY rejects from resistance, what is the rest of the market doing? Conditions are likely bullish if assets continue to rise while DXY falls.

Keep an eye on the DXY chart when it reaches weekly or monthly resistance levels. The way price reacts to these key levels can give you clues to what’s next in the market.

Bitfinex CVD + Coinbase CVD

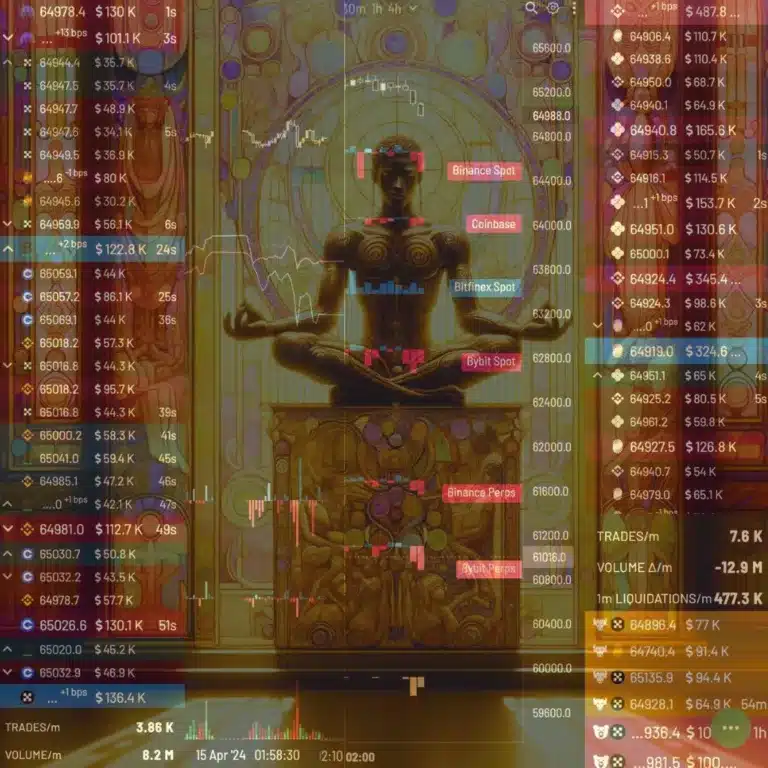

CVD (cumulative volume delta) is the net difference between buyers and sellers. Since Bitcoin leads the crypto market, it’s worth watching Bitfinex and Coinbase CVD to tell if buyers or sellers are in control.

Aggr is an excellent tool for monitoring CVD across all major exchanges. Aggr makes it easy to visualize which exchanges are currently leading the market.

Bitfinex has a reputation of being the home of Bitcoin whales. In the early days, Bitfinex was the only place to trade Bitcoin, and many traders still remain loyal to the exchange. Large changes in Bitfinex CVD and open interest can give you some clues into what larger players are thinking about the market.

Coinbase is one of the biggest retail exchanges in North America, so CVD can give you insight into what regular people think about the market. Coinbase also handles custody for several Bitcoin ETFs which impacts daily flows.

Summary

When you’re evaluating the market, remember to use the tools above as parts of your analysis. It’s easy to get tricked by false signals when you start relying on any one indicator too much. Combining the methods discussed in this article with basic technical analysis and tools like volume profile will help you make better decisions with your portfolio.

Next time you’re feeling confused about the market, you can use the indicators and tools in this article to give yourself context on current conditions. When you see conditions shift, you can start unstaking your crypto and preserving profits.

The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.”— Jesse Lauriston Livermore

Market Conditions Are The Great Equalizer