“Risk is the price you pay for opportunity.”

Navigating the crypto world can sometimes feel like dodging mines on an active battlefield. Staking your AVAX means exposing yourself to either smart contract risk or the risk of holding your funds on a centralized exchange.

As a safe and reliable protocol, BenQi offers a nice change of pace in the hectic crypto world. While you won’t find exorbitant APY’s on BenQi, you will find a stable platform for lending, borrowing, and earning on your AVAX.

With over $500 million in TVL, BenQi is the leading liquid staking protocol on Avalanche. Companies like Gensis Block Ventures, Ava Labs, and TRGC have invested in BenQi, allowing the team to expand the protocol and the treasury. In this article, we’ll look at liquid staking AVAX with BenQi, how the lending/borrowing protocol works, and an overview of the Qi token.

BenQi Protocol Overview

Liquid staking AVAX

Normally, staking on Avalanche means you have to use the P-chain or a centralized exchange. Validators on the P-chain verify transactions that get executed on the C-chain and on subnets that run on Avalanche. Staking on the p-chain requires locking your AVAX for a predetermined amount of time.

Liquid staking allows people to use their AVAX while still earning staking rewards. The BenQi protocol tokenizes staked AVAX into sAVAX, which you can use in any DeFi protocol on Avalanche. The value of sAVAX is calculated by taking the total amount of AVAX staked divided by the total amount of sAVAX minted and then multiplied by the current AVAX price.

sAVAX Contract Address

0x2b2C81e08f1Af8835a78Bb2A90AE924ACE0eA4bE

BenQi makes it easy for regular people to stake their AVAX – you don’t have to commit to any lock-up periods, and there are no fees for depositing or withdrawing AVAX from the protocol.

You can start staking AVAX for around 5.9% APR on the BenQi staking page. https://staking.benqi.fi/stake

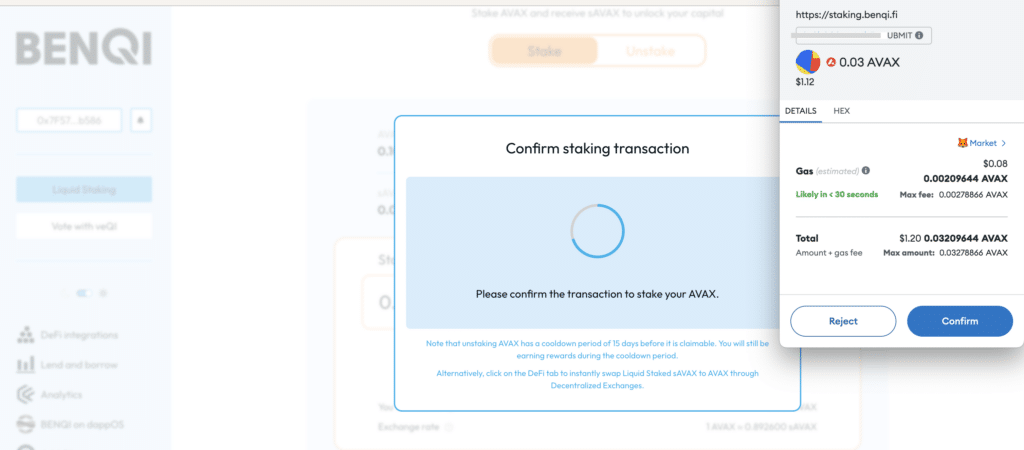

Click Stake, then confirm the transaction in Metamask.

If you want to unstake your sAVAX for AVAX, use the unstaking tab. When you use the unstaking tab, you don’t have to pay any fees, but you will have to wait 15 days to get your AVAX. Once the 15 day period is done, you have 2 days to claim your AVAX, otherwise, it gets deposited back into the protocol. Look for your AVAX under the Active Claims tab.

Don’t worry – if you need to instantly convert your sAVAX, you can use any of the decentralized exchanges on Avalanche. Trader Joe and Pangolin are great options. You can swap your sAVAX for any other asset, but you’ll have to pay fees.

https://docs.benqi.fi/benqi-liquid-staking/overview

Lending and Borrowing

BenQi also offers a lending and borrowing protocol, which is another way you can earn on your AVAX or sAVAX.

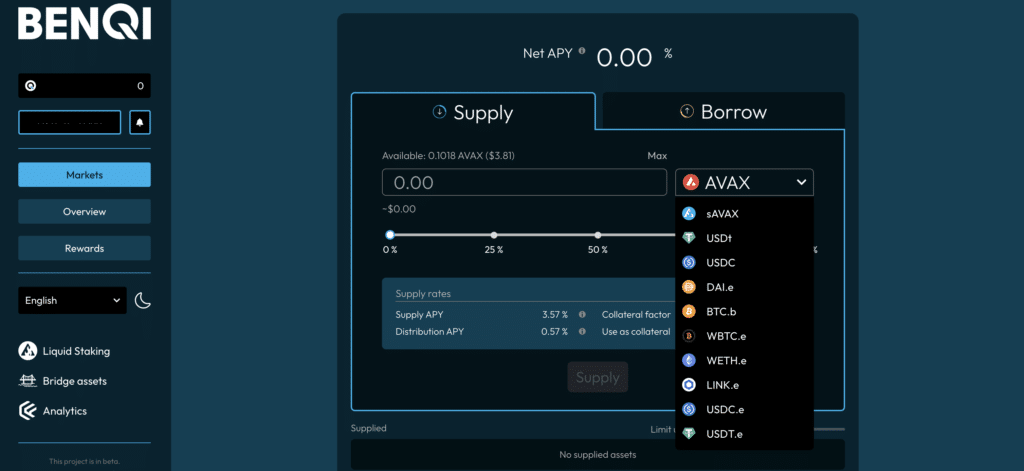

BenQi allows you to deposit and earn on a variety of assets, including AVAX, LINK, BTC.b, wETH, USDT, and more. Each asset has its own supply and distribution APY, which you’ll earn for keeping your tokens deposited in the protocol. Each asset also has its own collateral factor, which is the maximum percentage you can borrow against that asset.

When you lend tokens on BenQi, you’ll get rewards paid in QiTokens. QiTokens represent your asset balance (collateral + rewards) relative to the total BenQi, protocol. You can exchange qiAvax, qiWBTC, qiLink, etc., for the token’s regular versions. Use the rewards page to claim your earnings.

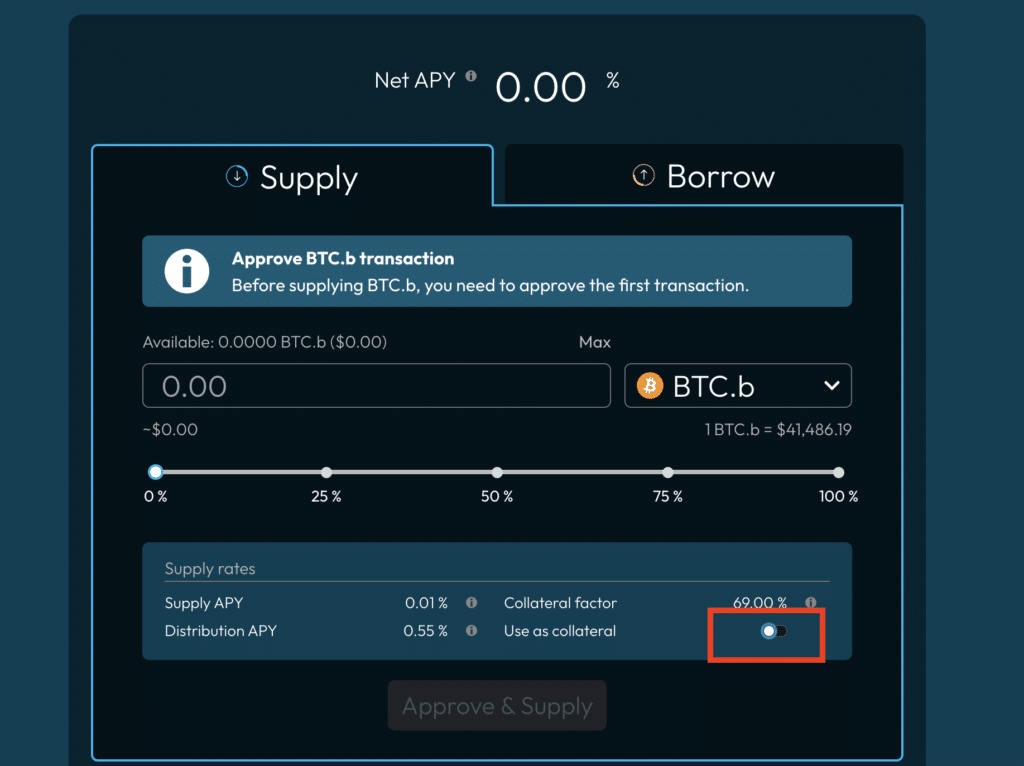

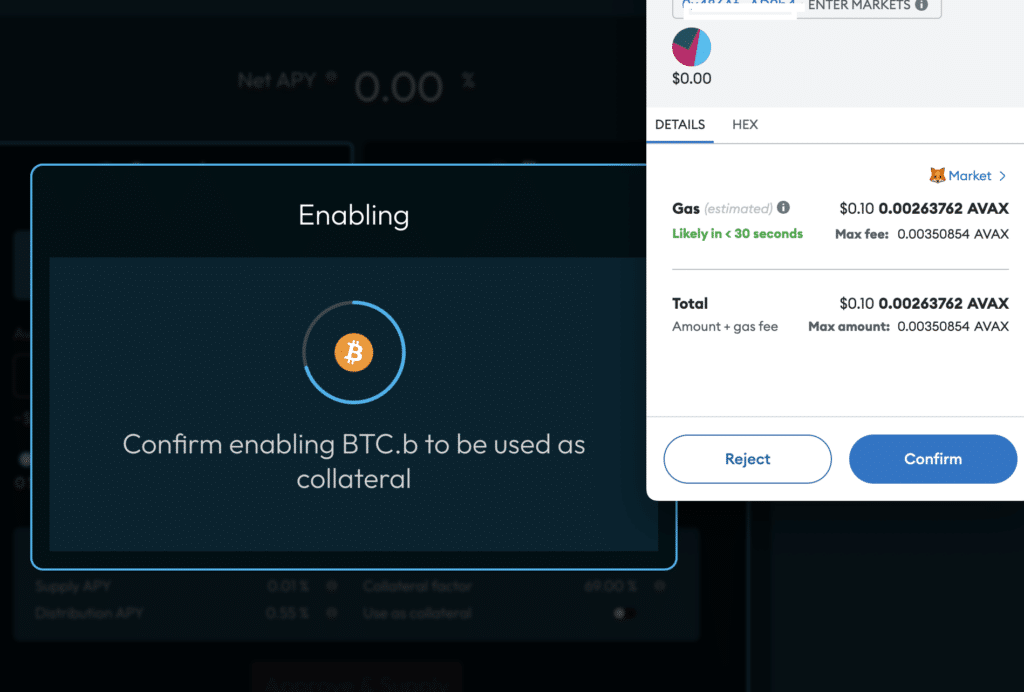

If you want to borrow against your deposited tokens, click the “use as collateral” button. Then, approve the Metamask Transaction that comes up.

Lending is one of the easiest ways to stake your AVAX. Lending adds liquidity to the BenQi protocol and is a relatively low-risk way to earn on your AVAX holdings.

When you borrow from BenQi, you’re essentially taking out an over-collateralized loan. You’ll pay an APY on any borrowed funds, which fluctuates depending on which asset you borrowed.

While there’s no time limit for repaying your loans, the loans are overcollateralized, giving users an incentive to use the borrowed funds wisely so they can eventually withdraw their collateral.

BenQI uses a health factor system to show when your account is close to liquidation. Keep an eye on changes in the market and how they affect your health factor. Once your health factor starts going over 1, a portion or all of your collateral will be liquidated.

Qi Token

At the time of writing, the Qi token is worth $0.02125 USD with a fully diluted market capitalization of $153 million. The Qi token is used to vote on proposals and validators can stake Qi to receive additional rewards.

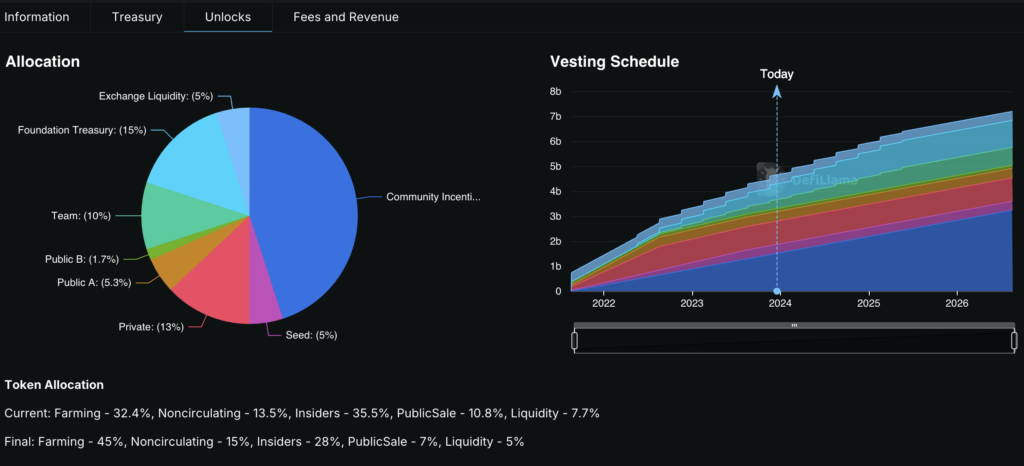

| Qi Token Distribution | # Of Qi Tokens | % of Total Supply (7,200,000,000) |

| Liquidity Mining Program | 3,240,000,000 | 45% |

| Token Sale | 1,800,000,000 | 25% |

| Treasury | 1,080,000,000 | 15% |

| Team | 720,000,000 | 10% |

| Exchange Liquidity | 360,000,000 | 5% |

Token allocations to the treasury, team and for the liquidity mining program are projected to end in 2026. It’s important to keep in mind how the token is used if you’re considering speculating on Qi. Currently the only use is for voting and extra validator rewards, which are catalysts that cause coins to double or triple overnight. Long term, you may be able to get a good return on Qi thanks to the smaller market cap, but you’ll likely be better off speculating on tokens with more attention. At this time, using the BenQi protocol to maximize your holdings is the best use of your time.

Liquid Staking On Avalanche: BenQi Protocol Overview