While Total Value Locked (TVL) can give you some valuable information, it’s a generally overrated indicator and a representation of an archaic way of doing things.

Today, we’re looking at the Delta Prime protocol on Avalanche, which, instead of TVL, focuses on how much value they can unlock for their users.

What does this mean? Delta Prime allows users to take undercollateralized loans – you can borrow more funds than you deposit.

The Delta Prime protocol focuses on putting locked funds to work and maximizing liquidity within the protocol. In this article, we’ll look at how to use Delta Prime, how the protocol works, and a few strategies you can use to maximize your portfolio.

What Is Delta Prime?

Delta Prime is a lending platform on Avalanche & Arbitrum. Delta Prime stands out since they offer undercollateralized loans that you can use to increase your size in Liquidity Pool and farming positions.

The Delta Prime protocol works by separating your portfolio into 2 accounts: your savings and your Prime account.

Savings Account

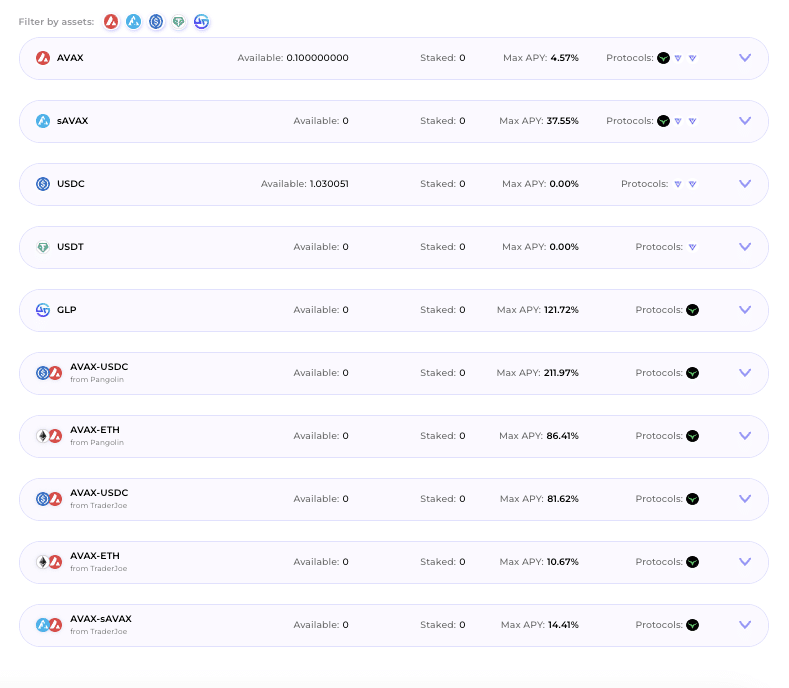

Under savings is where you can lend tokens. Any token you lend starts earning starts yield paid in sPRIME.

Lenders on Delta Prime get paid by borrowers who pay an interest fee to keep their borrowing positions open. The Delta Prime protocol maximizes all the locked value deposited by lenders by allowing Prime Account users to borrow these funds and farm within the Delta Prime Protocol.

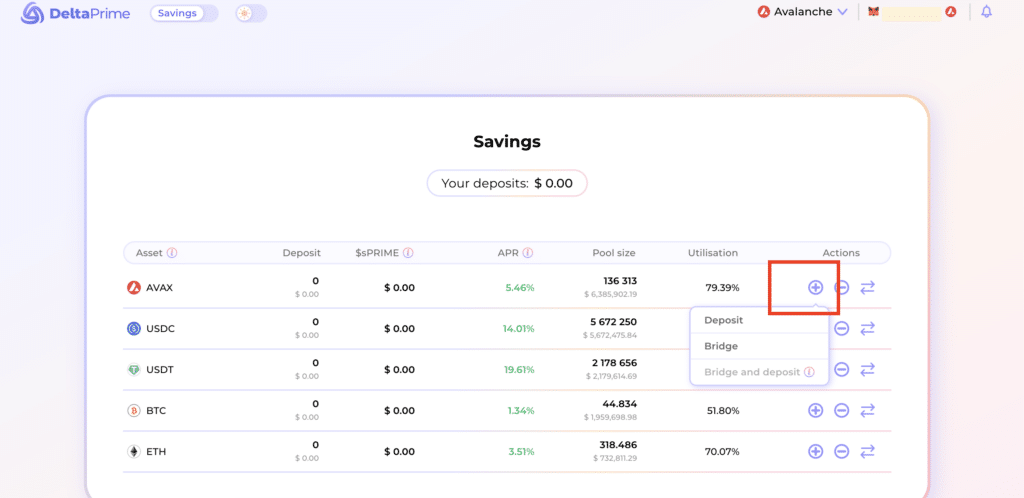

Start by navigating to the Savings page, then click the + symbol next to the asset you want to deposit.

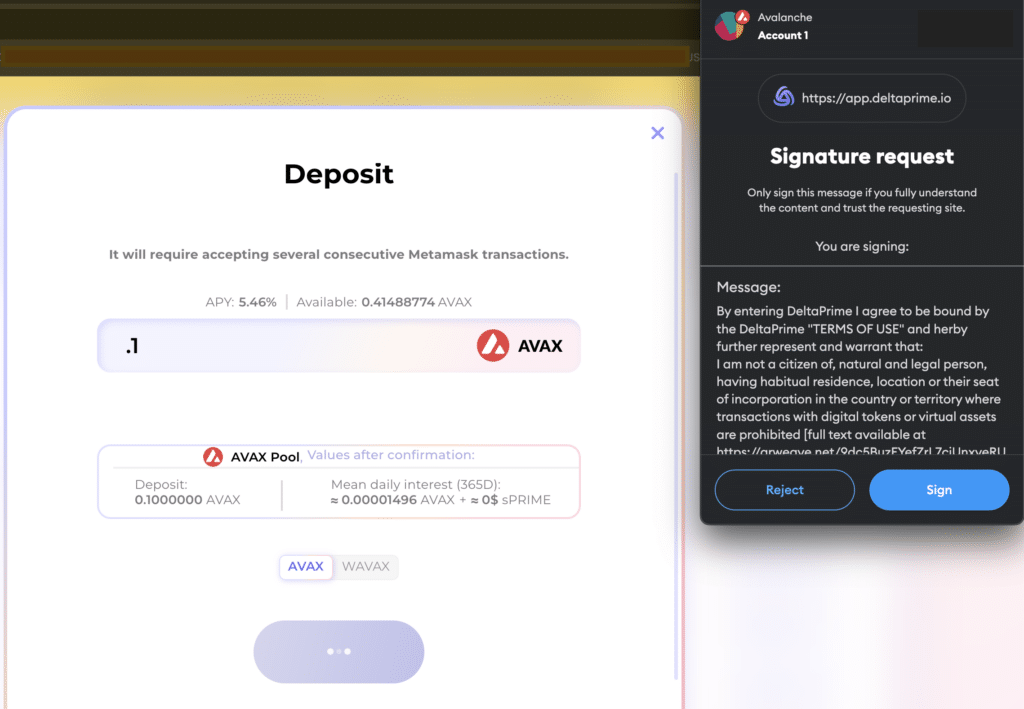

Next, you’ll need to complete the signature request and then confirm your transaction. Now, your funds will start earning yield in the Delta Prime protocol.

Prime Account

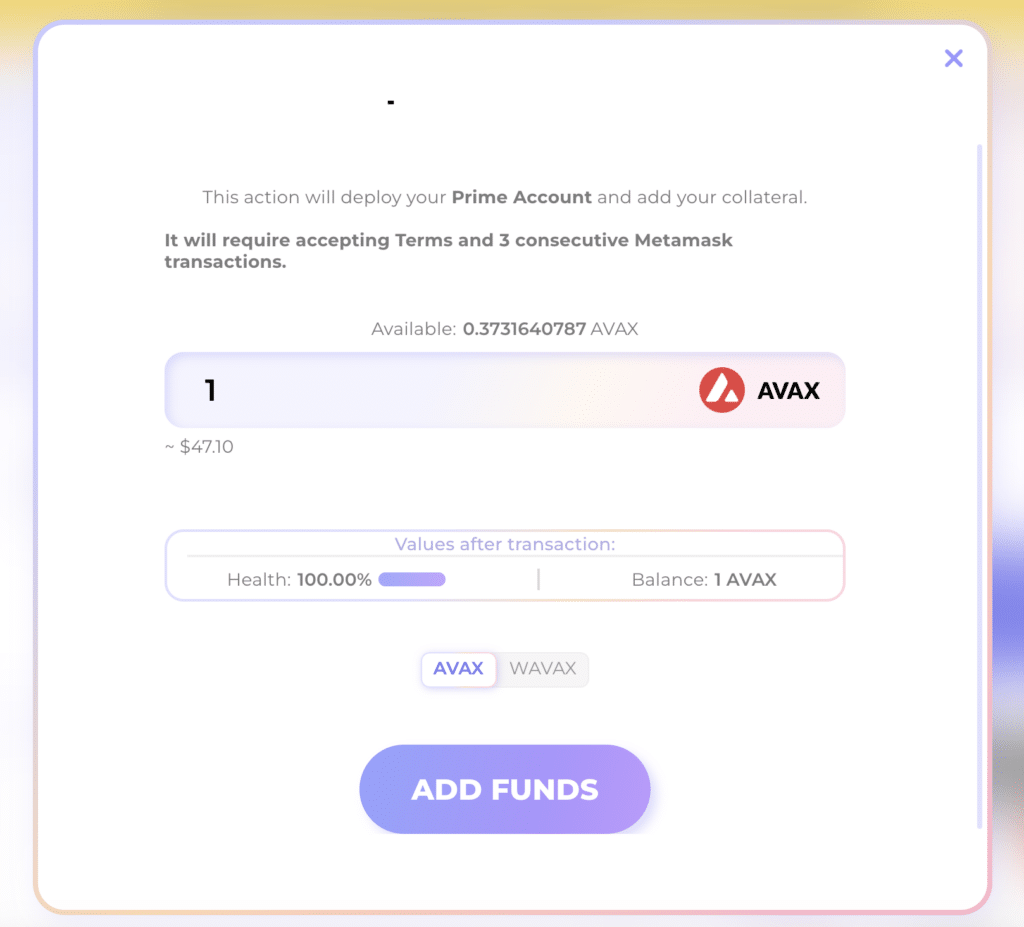

Using your Prime Account, you can multiply the size of your portfolio. Start by depositing tokens into your Prime Account under the “assets” tab.

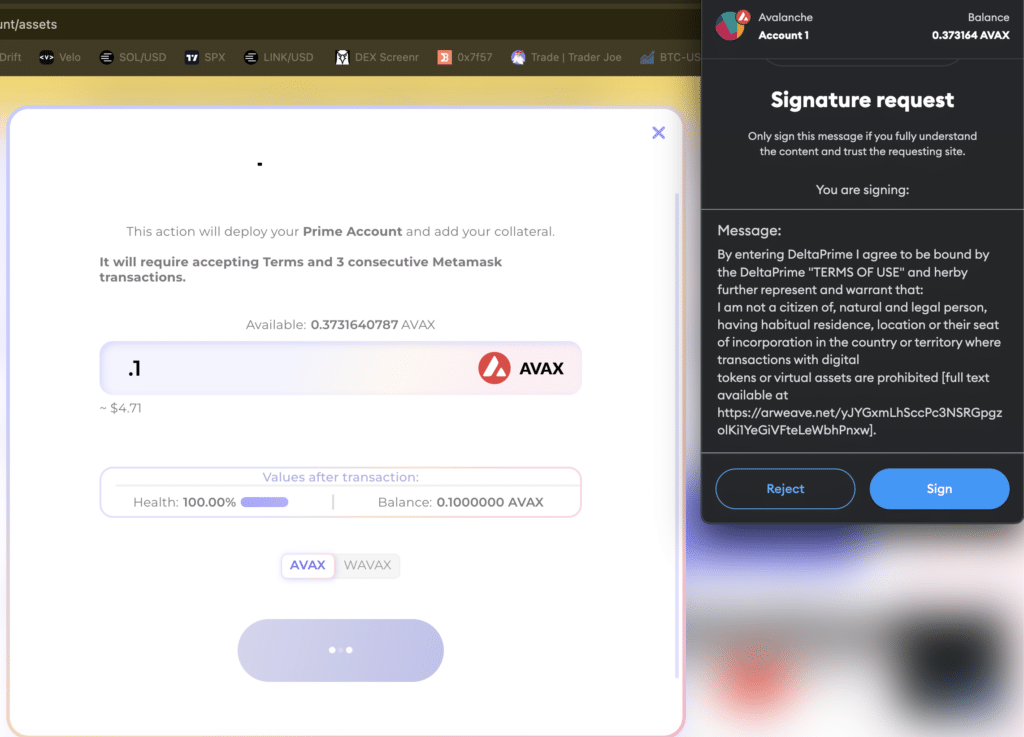

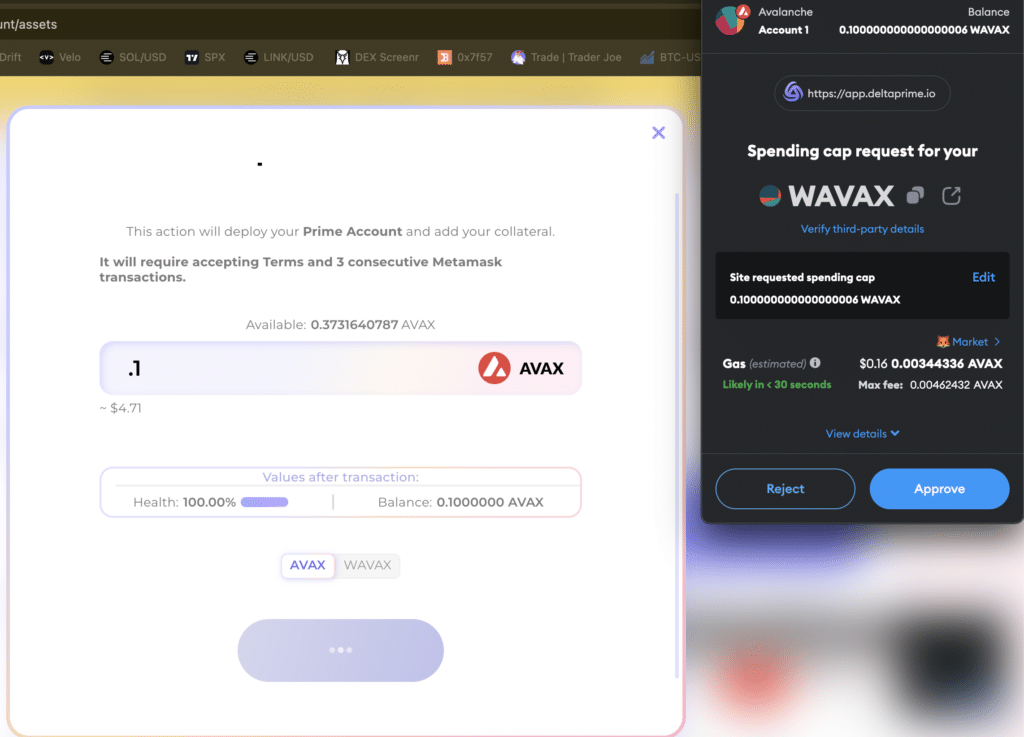

When depositing for the first time, you’ll need to complete a signature request and confirm three transactions in a row.

After you complete the signature request, stay on the screen and wait for the rest of the Metamask prompts to come up. Once all 3 transactions are complete, you’ll see your tokens on the asset tab.

Now, with funds in your Prime Account, you can borrow up to 5x the amount you deposited.

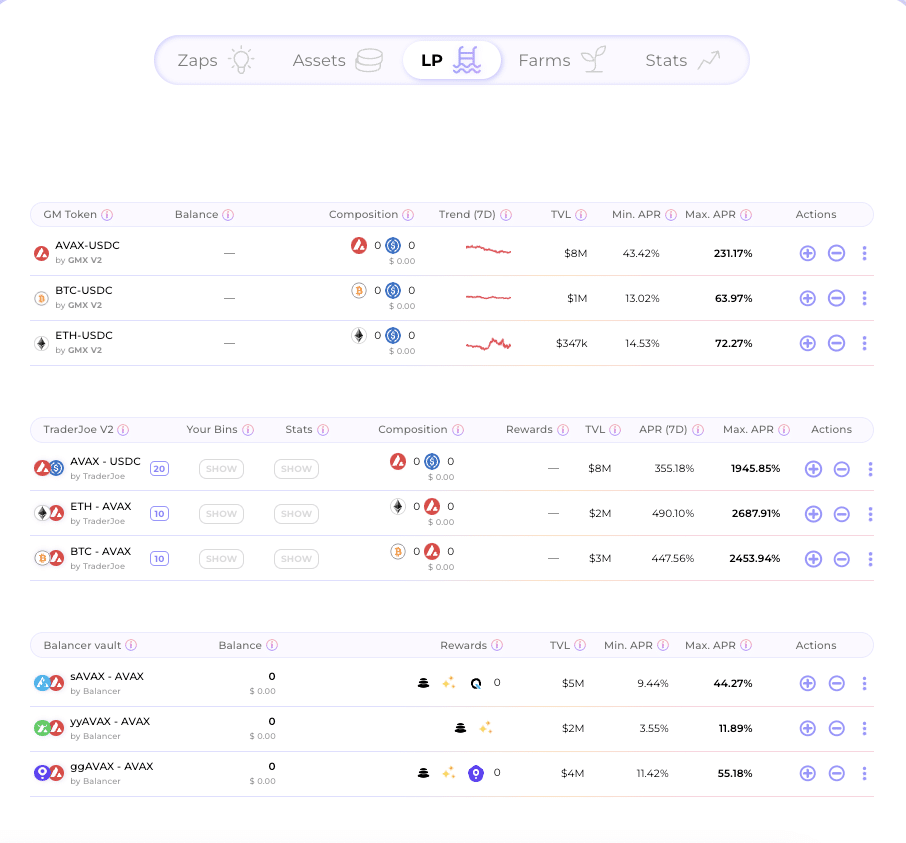

With your borrowed funds, Delta Prime allows you to provide liquidity to earn yield and farm rewards through Yield Yak, GMX V2, Trader Joe, Balancer, Steak Hut, and Pangolin.

Use a combination of your collateral and borrowed funds to enter one of the liquidity pools.

Once you have your LP tokens, go to the Farm page and deposit your LP tokens in a farm. Now, you’re earning from both the liquidity pool and the farm.

The liquidity pool and farm you enter need to match. On the LP pool page, you can enter pools from GMX V2, Trader Joe, Balancer, Steak Hut, and Pangolin. After depositing and going to the farm page, make sure you deposit your LP tokens in the farm from the same provider that you deposited in.

Delta Prime LP & Farm Strategies

Maximize your existing holdings

The easiest way to use your Prime Account is to increase your available money to farm yield. Borrowing, LPing, and farming allow you to make use of otherwise stagnant capital. If you deposit $500 into your prime account, you can now farm with $2500 worth of capital.

Take a directional bet with your portfolio

Let’s say you think AVAX is going to go up in the near term. You can deposit AVAX as collateral and use it to borrow 5x more sAVAX. Now you can enter the AVAX/sAVAX liquidity pool and the AVAX/sAVAX farm to earn a yield on your deposits.

In the above situation, both your collateral and borrowed funds would fluctuate in value based on the AVAX price. If the market goes up 30%, you can exit your farming positions, swap your debt (AVAX) for USDC and wait to repay your loan once the price decreases. Now that you have AVAX and USDC, you can enter the AVAX/USDC pool to farm rewards while minimizing your downside risk.

You can also take a long position on the market with less risk by using USDC as collateral instead of AVAX. With collateral that doesn’t change in value, you can use your debt as exposure to AVAX price movements.

If you think the market is going down, you can supply and borrow stablecoins and earn yield while the value of your collateral stays the same.

Opening a position:

| Delta Prime Product | APY offered | Total APY With 5x Multiplier |

| Borrowing Cost | -5% | -25% |

| Liquidity Pool | +5% | +25% |

| Farm | +3% | +15% |

| Total Position APY | 3% | +15% |

The Liquidity Pools and Farms offered on Delta Prime are run by other protocols. The APY is generated by transaction fees that are distributed to liquidity providers. The APYs will fluctuate based on activity on the third-party protocols.

Follow these strategies from Delta Prime

Check out Delta Prime’s docs for overviews on the following strategies:

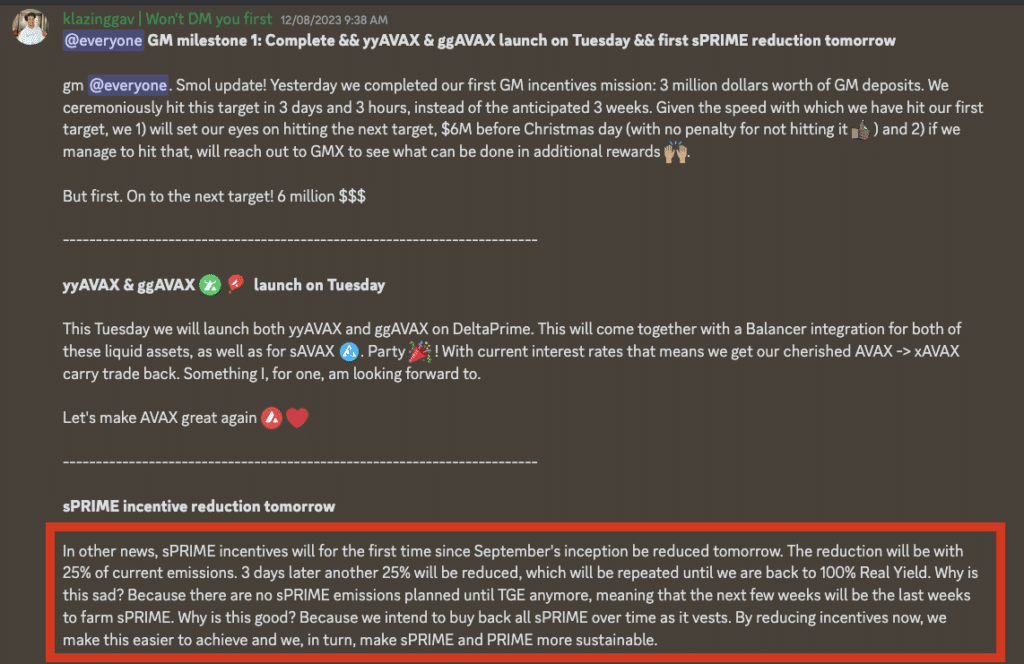

Token Generation Event (TGE)

Delta Prime received a $300,000 grant from Ava Labs, which they announced they will use for their token generation event. The TGE is expected to take place in Q1 2024.

After the TGE, tokens are locked for 6 months. Keep an eye on TVL and borrow TVL on Delta Prime as the TGE gets closer, which will help you decide if PRIME is worth buying on launch.

Delta Prime Protocol Overview