KuCoin vs Coinbase – which is right for you? Picking an exchange requires a bit of research before you commit to uploading your personal details to verify your account. KuCoin and Coinbase are both reputable centralized exchanges that offer a variety of financial services related to cryptocurrency markets. In this article, we’ll compare the trading interfaces, fees, security, and earning opportunities available on each exchange.

KuCoin vs Coinbase: Trading Interfaces

If you consider yourself a trader, this is the section that will concern you the most.

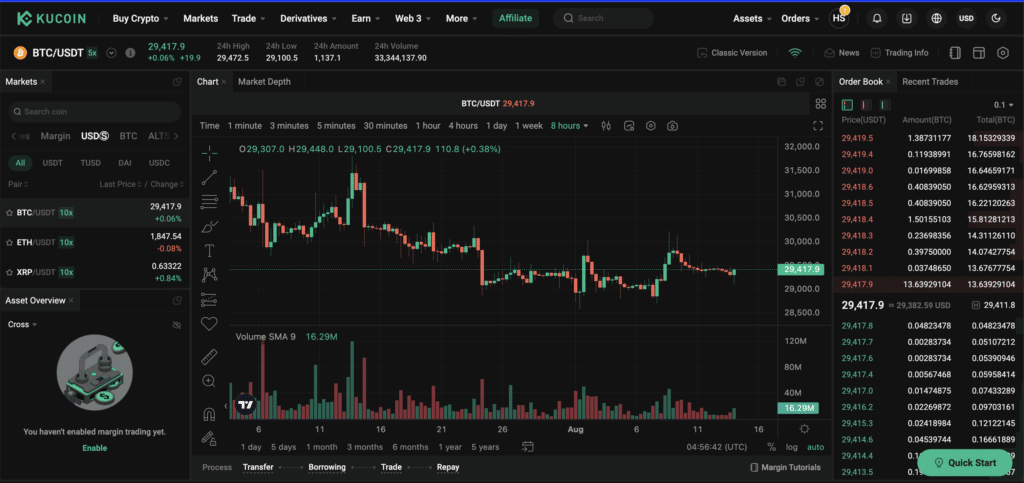

When it comes to pure trading, KuCoin is the better platform. For limit and market trades, you can expect to pay 0.1% of your position in fees. KuCoin offers futures on a variety of assets, and you can use margin to increase the size of your position.

Traders will find KuCoin’s margin trading platform similar to other exchanges such as ByBit and Binance. KuCoin also supports various order types, including Good-Till-Cancelled (GTC), Immediate-or-Cancel, and Fill or Kill (FOK).

You can read more about margin trading on KuCoin here.

https://www.kucoin.com/support/900002211683

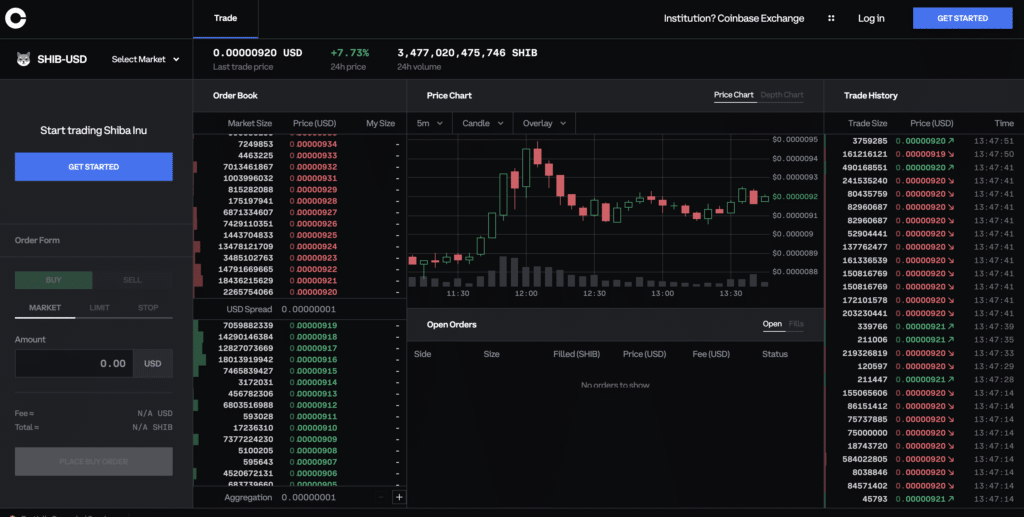

As mentioned above, Coinbase doesn’t offer as many options on its trading platform. Margin trading is only available to Coinbase Pro and Coinbase Advanced users. If you need to execute simple buy and sell orders, the regular Coinbase interface is a good choice. If you want to trade with leverage and set limit orders, you’ll need to look into Coinbase Pro or Coinbase Advanced, depending on your country.

https://www.coinbase.com/advanced-trade

KuCoin Vs Coinbase: Security

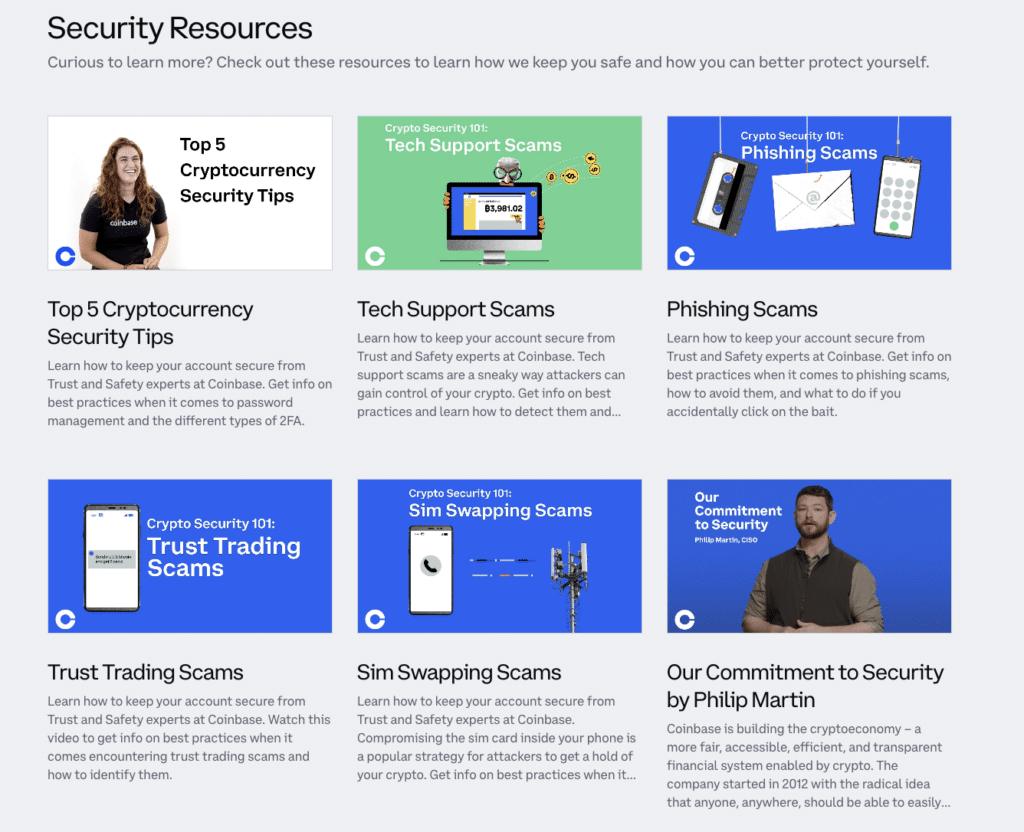

Coinbase uses a variety of security tactics to help you keep your account safe. You can secure your account with 2-factor authentication and biometrics through your phone. Coinbase also stores the majority of customer funds in cold storage to reduce the severity of a potential hack.

Coinbase is insured by crime insurance that protects a portion of digital assets on the Coinbase platform. Crime insurance covers potential cybersecurity breaches that result in theft from users. However, if you lose your account information or if your account gets hacked, this type of insurance doesn’t cover you. Always keep backups of your passwords in a safe place offline.

Despite suffering from hacks in the past, KuCoin is still a highly secure platform. KuCoin uses a variety of security techniques, including protecting the platform with multi-layered encryption and using micro-withdraw wallets to minimize the amount of assets in hot wallets.

During the 2020 hack, $150 million was stolen, but KuCoin’s team managed to recover most of the assets, and customers didn’t suffer any losses. KuCoin currently has an insurance fund designed to protect users from overleveraged players with large liquidations that can cause disruptions on the exchange.

You can secure your KuCoin account with Two-factor authentication, a unique trading password, phone verification, and email verification.

Overall, you can feel confident leaving funds on both exchanges. Of course, the best option is keeping your funds on-chain with a secure hardware wallet, but if you’re a CEX trader, you can feel relatively safe leaving your funds on Coinbase or Kucoin.

KuCoin Vs Coinbase: Fees

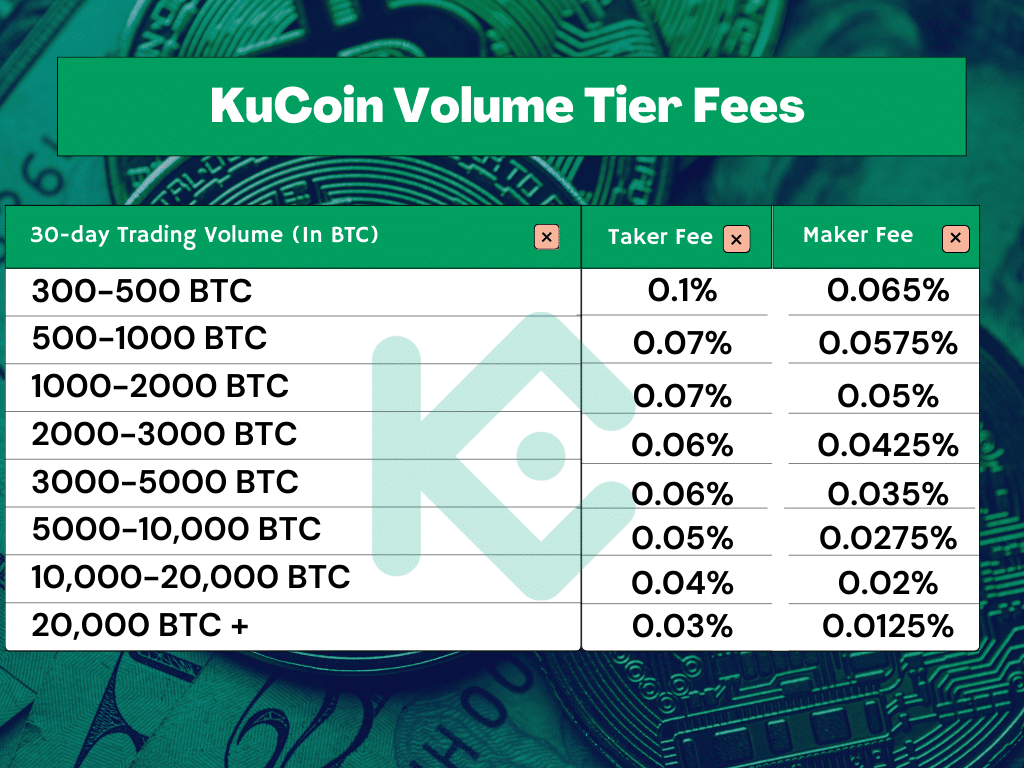

Like many exchanges, KuCoin uses a maker/taker fee model. Basically, as a maker, you pay less fees to enter and exit your position.

You become a maker by using limit orders to enter and exit your trades. Limit orders add liquidity to the exchange order book, which is why they are able to charge you less fees.

However, as a taker, you enter and exit your positions based on the current market price. This type of action takes liquidity away from the exchange, which is why they charge higher fees to takers.

When withdrawing on KuCoin, you’ll have to pay network fees associated with the blockchain that you are using.

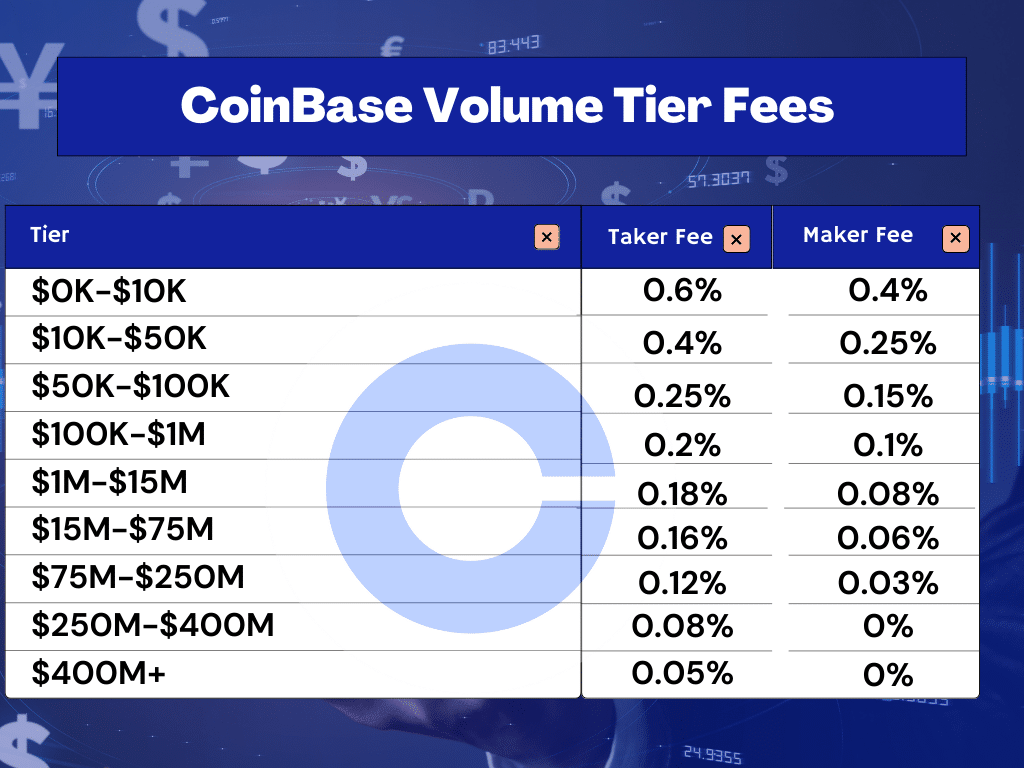

Coinbase also uses the maker/taker model, and you’ll also pay less fees as a market maker. You can expect to pay around 0.4% of your position as a fee as a maker and between 0.5% to 0.6% as a taker.

On Coinbase, you’ll also need to pay transaction fees for the network that you want to use. If you want to transact on Ethereum, you’ll need to pay gas fees in addition to Coinbase’s regular fee.

Lastly, both KuCoin and Coinbase charge fees based on the amount of volume transacted by your account. Check out the two charts to see the fees you can expect to pay based on volume on KuCoin and Coinbase.

KuCoin vs Coinbase: Earning Opportunities

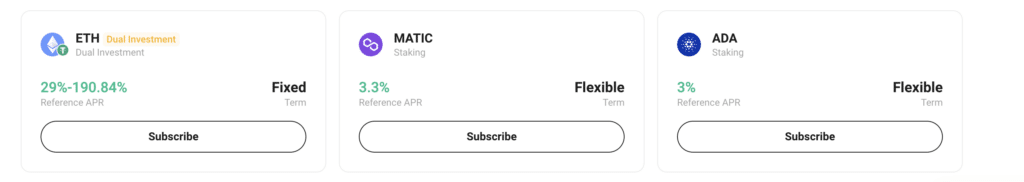

Through KuCoin earn, you can get paid to stake your crypto with KuCoin. KuCoin offers a variety of earning options, some of which require you to lock your crypto and others where you can withdraw at any time. You can stake most major tokens, including BTC, USDT, ETH, BNB, and more, for between 0.73%- and 144% apr. Check out more about KuCoin earn here.

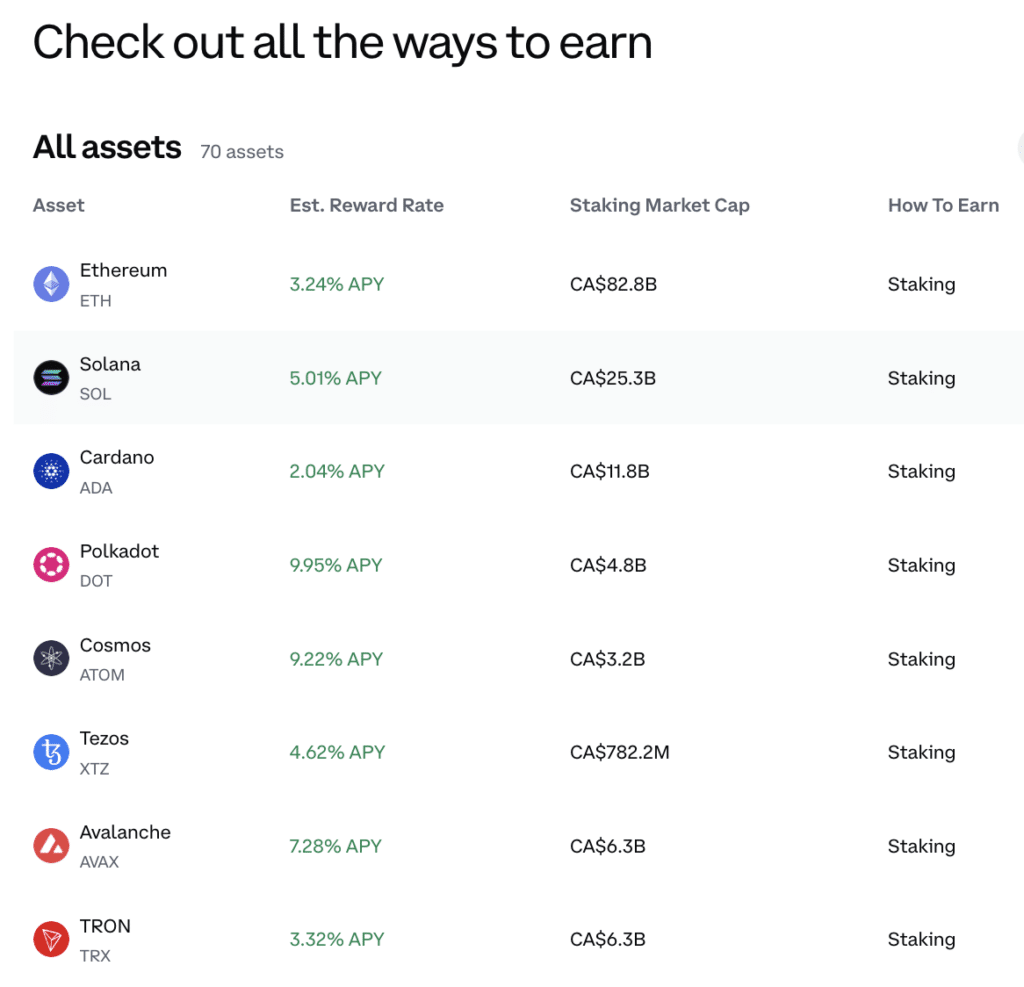

Coinbase also allows you to stake your tokens in exchange for yield. You can stake 65 different tokens on Coinbase for between 2% – 10% APY. You can stake AVAX, BTC, USDC, ETH, SOL, and more tokens on Coinbase. If you’re looking for a simple way to stake on a centralized platform, Coinbase earn provides a secure platform you can use.

BASE (Layer 2)

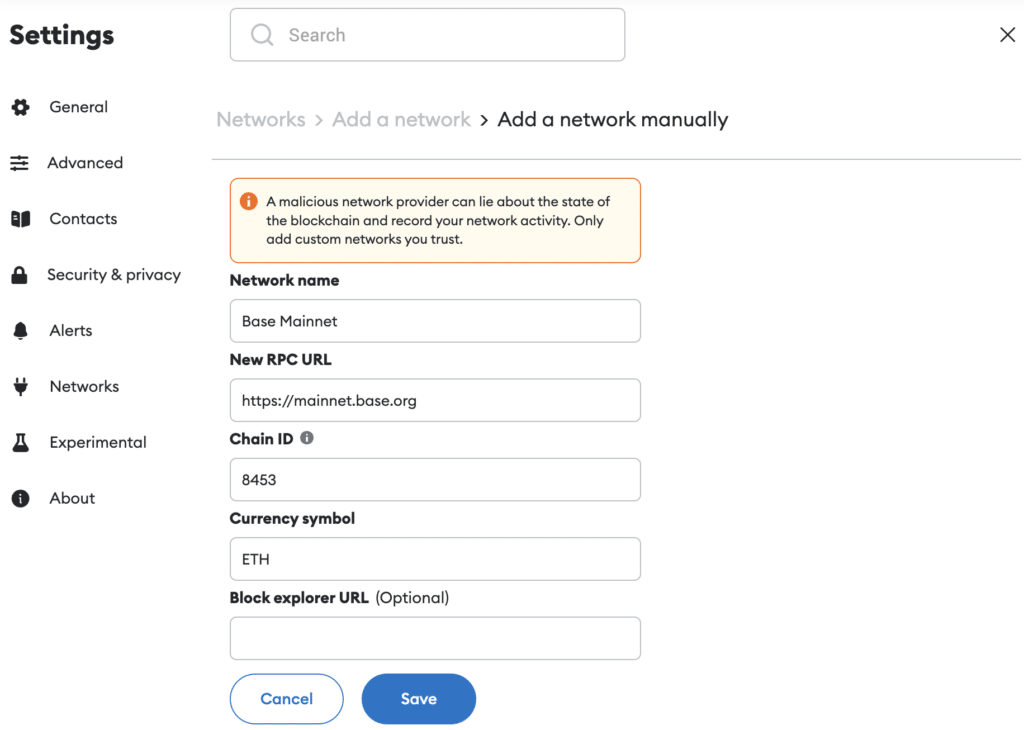

In addition to the basic staking products, BASE is a layer 2 blockchain offered by Coinbase. BASE is built on top of Optimism stack, which offers users a similar experience in fees and transaction fees.

BASE is essentially a decentralized blockchain where you can interact with dApps while feeling reassured that Coinbase will protect the network. Coinbase will also likely fund certain dApps launching on BASE, which will provide profitable opportunities for token holders. Interacting with new dApps and tokens on new blockchains like BASE can be an extremely lucrative way to earn money. Remember to thoroughly research all projects before committing to connecting your wallet to new websites.

How To Connect to BASE:

- Download the Coinbase Wallet App

- Click Settings in the lower right corner of the Coinbase App

- Choose Active dapp network

- Select Base Görli under ETH Testnets

https://help.coinbase.com/en/coinbase/other-topics/other/base

In conclusion, when it comes to KuCoin vs Coinbase, the best exchange will depend on your needs. If you need to buy crypto quickly and send it to a different wallet, Coinbase is a great choice. Coinbase offers an easy-to-use interface and access to all the popular crypto tokens. Coinbase is usually a good choice for people just entering crypto.

However, if you need to execute trades on a low timeframe, KuCoin is the better option. KuCoin has more tools for professional traders to use, including access to margin trading and an interface that’s more familiar to traders.

Both exchanges are about equal regarding staking rewards on major cryptocurrencies.

KuCoin vs Coinbase Comparison:

- KuCoin vs Coinbase Trading Interfaces:

- KuCoin is preferable for traders with a variety of options for limit and market trades, futures, and margin trading.

- Coinbase Pro (or Coinbase Advanced) is suitable for simple buy and sell orders, with limited options for margin trading.

- KuCoin vs Coinbase Fees:

- Both KuCoin and Coinbase use a maker/taker fee model.

- KuCoin charges 0.1% for limit and market trades, while Coinbase charges around 0.4% as a maker and 0.5-0.6% as a taker.

- Withdrawals on both platforms incur network fees specific to the blockchain you’re using.

- Security:

- Coinbase uses 2-factor authentication, biometrics, and cold storage for customer funds. It has crime insurance for cybersecurity breaches.

- KuCoin uses multi-layered encryption, micro-withdraw wallets, and an insurance fund to protect users.

- Earning Opportunities:

- KuCoin offers earning options through KuCoin Earn, allowing users to stake various tokens for APR between 0.73% and 144%.

- Coinbase provides staking options with 2%-10% APY for 65 different tokens.

- Coinbase also offers BASE, a layer 2 blockchain, with new protocols.

- Conclusion:

- Coinbase is user-friendly for quick transactions and access to popular cryptocurrencies.

- KuCoin is more suitable for active traders with tools like limit orders, margin trading and a familiar interface.

- Both exchanges offer comparable staking rewards for major cryptocurrencies.

KuCoin vs Coinbase -Everything You Need To Pick An Exchange